Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

17 resultsPage 1

Infographic

Infographic

Standard credit scores overlook crucial financial behaviors, leaving 62 million U.S. consumers that are thin file or credit invisible without a score.

With alternative data, lenders can:

Report

Report

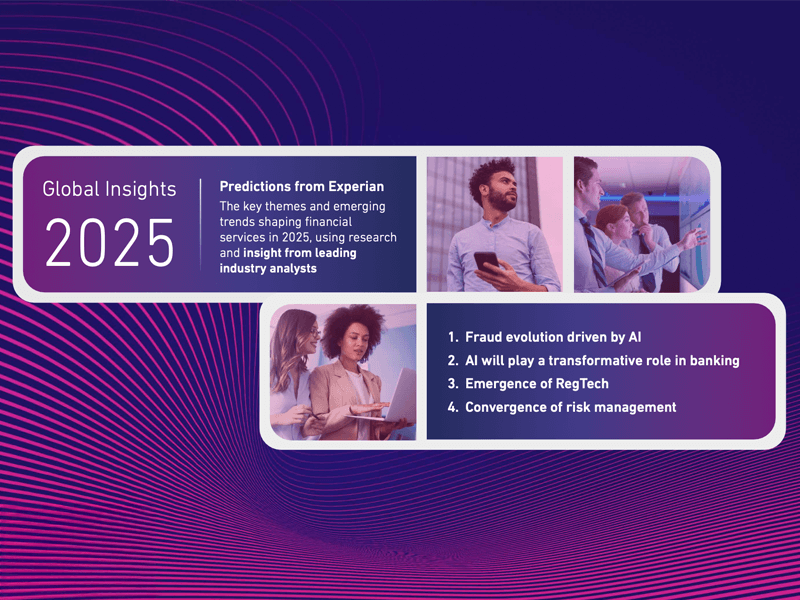

Key themes and emerging trends shaping financial services in 2025, using research and insight from leading industry analysts. Themes include:

Report

Report

Dive into Experian Clarity Services' latest quarterly report on alternative financial services (AFS). Our comprehensive analysis of key metrics and scores offers valuable insights into consumer behavior in the AFS sector.

This quarter's report covers:

Elevate your understanding of the AFS industry. Access the Experian Clarity Services Quarterly Insights Report now to uncover insights that fuel success in today’s dynamic financial landscape.

Report

Report

Discover invaluable insights with Experian Clarity Services' 2024 Alternative Financial Services Lending Trends report. This exclusive report reveals trends and consumer behaviors, from market size to loan performance. Equip yourself with the essential information to plan effectively and stay ahead.