Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

14 resultsPage 1

White Paper

White Paper

ITIN holders are active, responsible participants in the U.S. credit economy — yet many remain overlooked by traditional lending models.

Our white paper takes a closer look at this financially active and resilient population, revealing key insights into their credit performance and long-term growth potential.

Some findings include:

Read the full white paper for more insights.

Tip Sheet

Tip Sheet

This summary outlines important research findings that help lenders drive a more inclusive environment for customers, while mitigating risk.

A few takeaways:

Webinar

Webinar

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

White Paper

White Paper

Read the latest findings about "Closing the credit gap" white paper, and what they mean for financial inclusion and risk management.

Key insights:

Case Study

Case Study

Every lending decision you make relies on data, but what if that data only tells part of the story? Download our use case to meet two borrowers, Claudia and John, and discover how alternative data can help you:

Case Study

Case Study

Our use cases share real-world examples of how cash flow insights help grow portfolios responsibly while expanding credit access. Explore scenarios across borrower types, including:

Infographic

Infographic

Millions of U.S. households remain unbanked, yet many possess the ability to borrow responsibly. Read our infographic to learn how you can leverage real-time cashflow data to:

Infographic

Infographic

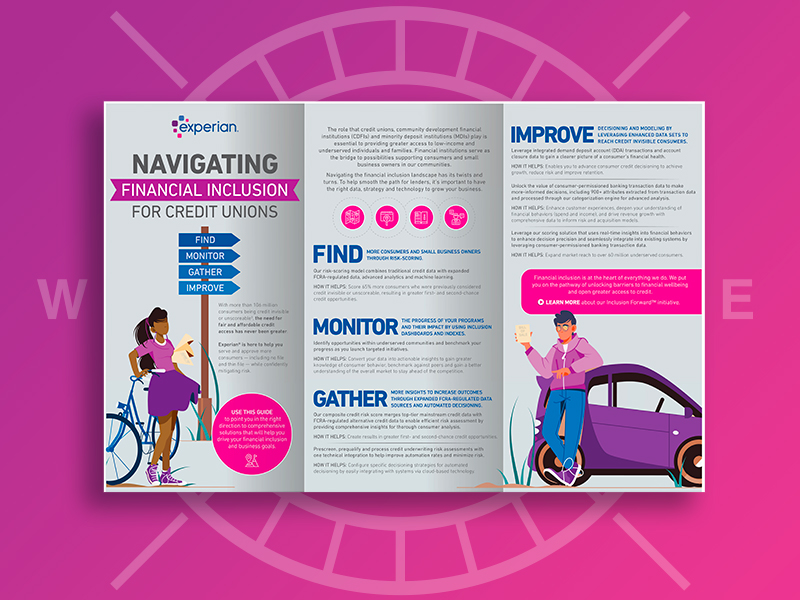

While lenders like credit unions, CDFIs, and MDIs help bridge the gap to financial possibilities for consumers and small business owners, navigating the financial inclusion landscape can still be challenging. Allow Experian to guide you to business growth within underserved communities – helping you to find and approve more consumers while confidently mitigating risk. Learn how our portfolio of data and analytic solutions helps drive your business goals at every turn. We specialize in providing strategic consulting to help you elevate your financial inclusion approach.

Video

Video

For lenders, navigating the map to financial inclusion can be full of twists and turns. It's even more challenging when you don't have the right data, strategy, and technology to grow your business. Experian helps financial institutions and lenders find and approve more consumers while confidently mitigating risk at every turn.

Our team specializes in providing strategic consulting to help you elevate your inclusive finance approach. We can help you remove those roadblocks and get you on the right path to new growth opportunities.

Maximize the value of data and analytics to optimize decisioning and enhance the consumer experience. See how our portfolio of financial inclusion solutions helps drive your business goals at every turn.

Get on the road to inclusive finance today!