Report

Published July 15, 2024

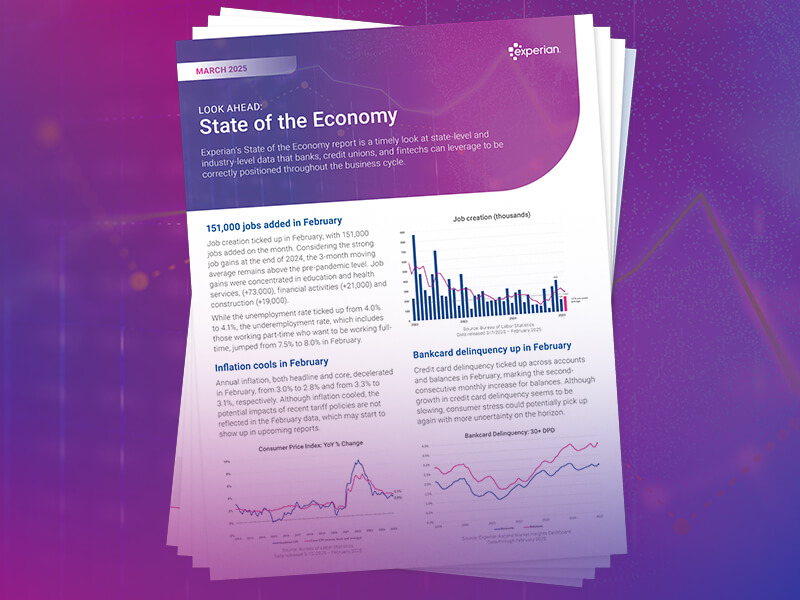

Banks Economic & Market InsightsExplore state-level and industry level data that banks, credit unions and fintechs can leverage to track the downturn and be correctly positioned for the recovery in this monthly report.

Complete the form to access the report

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Report

Report

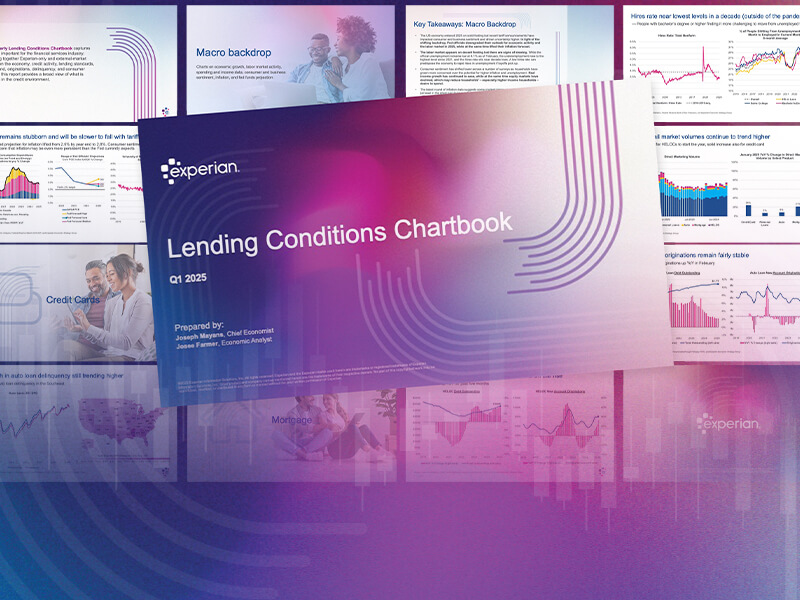

Lending Conditions Chartbook Q1 2025

In our Q1 Lending Conditions Chartbook, we break down the latest economic trends and dive deep into credit conditions across products and regions.

Insights include:

- The labor market appears on decent footing but there are signs of slowing.

- Credit growth remains subdued and is running below its pre-pandemic average as financial institutions maintain tight lending standards and interest rates remain elevated.

- Looking at origination activity, there has been a meaningful pickup among fintechs and in unsecured personal loans.

Video

Video

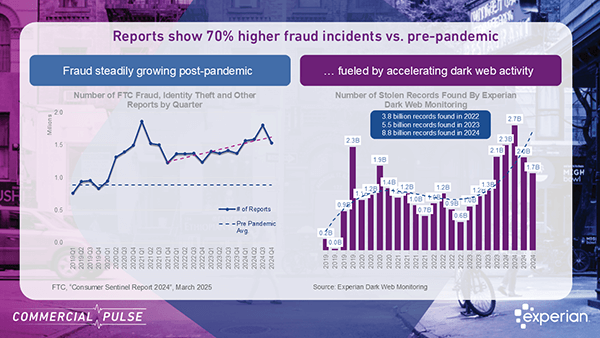

A Growing Small Business Financial Fraud Problem

This week’s Commercial Pulse Report from Experian reveals critical shifts in the economy for small businesses. Inflation eased slightly to 2.8%, and the Small Business Index ticked up to 41.5—signs of stabilization. But rising financial fraud remains a major concern. Also:

🔒 70% increase in fraud since the pandemic

🧠 $40B in projected losses from AI-driven scams by 2027

📊 46% of SMB loan applications showed signs of first-party fraud

Lenders are responding with AI-powered analytics and cross-industry collaboration to stay ahead of these threats.

Check out the full report to see how these trends could impact your strategy!