Best debt consolidation loans of 2026

Tired of juggling multiple balances? A debt consolidation loan can combine your high-interest debts into one manageable monthly payment.

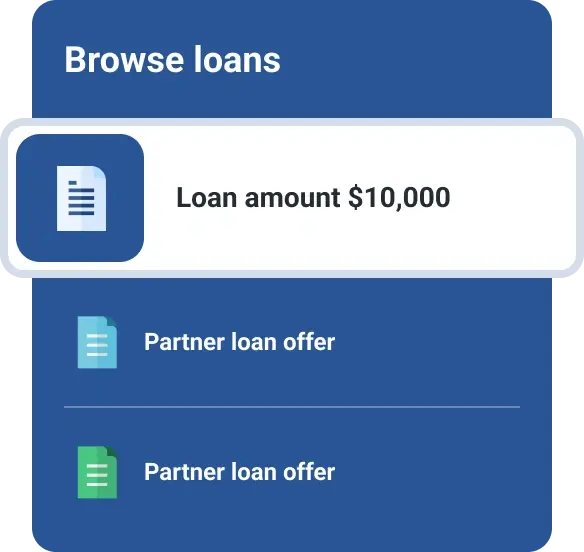

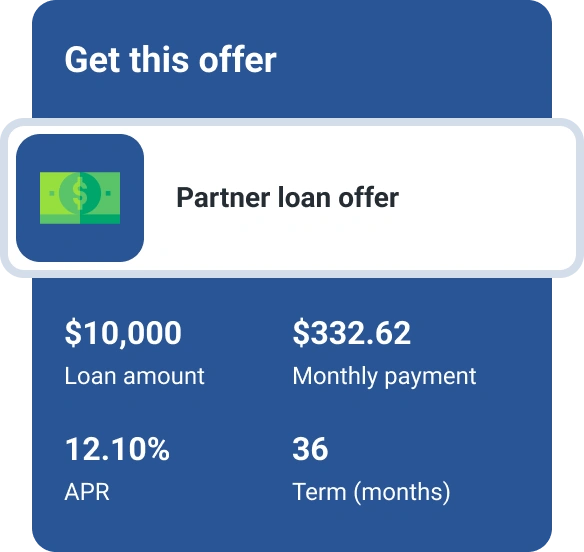

Compare debt consolidation loans from our partners

As of February 2026, compare personal loans with interest rates as low as 4.99%. You could potentially save thousands of dollars in interest.

Best for all credit score types

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 7.74 - 35.49% |

|---|---|

| Term | 24 - 84 mo |

| Loan amount | $5,000 - $100,000 |

| Est. monthly payment | $226 - $3,237 |

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Best for paying lenders directly

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.45 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,731 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 4.99 - 32.39% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $44 - $2,030 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.70 - 24.50% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $225 - $1,453 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 11.11% |

|---|---|

| Term | 12 mo |

| Loan amount | $1,000 - $10,000 |

| Est. monthly payment | $88 - $884 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $40,000 |

| Est. monthly payment | $226 - $1,445 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 26.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $15,000 - $50,000 |

| Est. monthly payment | $672 - $1,526 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 10.24 - 26.39% |

|---|---|

| Term | 24 - 72 mo |

| Loan amount | $3,000 - $50,000 |

| Est. monthly payment | $139 - $1,390 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.47 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $32 - $1,731 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

You could save up to $3,531* with a low, fixed-rate debt consolidation loan

| High-interest credit card | Debt consolidation loan | |

|---|---|---|

| Balance | $11,700 | $11,700 |

| Monthly payment | $334 for 60 months | $275 for 60 months |

| Average interest rate | 23.62% | 14.48% |

| Total paid with interest | $20,041 | $16,510 |

| *Estimated interest savings: $3,531 | ||

Experian could help find the right debt consolidation loan for you

It’s free

Check your loan options for free—it won’t hurt your credit scores.

Save on fees

Get matched to lenders that offer no application fees and no prepayment penalties. Look for these labels on your matched loan offers.

Loans for all credit types

Consumers with low credit scores or no credit history may have personal loan options available.

Get cash fast at competitive rates

Compare rates across multiple lenders and get your loan fast—with same-day funding available.

Get prequalified

Find out how much you can borrow before you apply. Getting prequalified helps you better compare options.

Loans from $1,000 to $100,000

Whether you have a small or large amount of debt, there is a loan option for you.

Why trust Experian for debt consolidation loans?

Shop trusted lenders all in one place

Experian works with reputable lenders to provide consumers with the best options.

Our model

Experian offers loan options tailored to your credit profile that could improve your chances for approval.

Security

Experian uses bank-level encryption and data protection to keep your information safe.