Credit Report and Score Solutions

Acquire consumers and earn trust with financial products that help manage their financial wellness.

Give consumers credit information and guidance to better understand, manage, and strengthen their financial well-being.

of major bank retailer's consumers whose credit score increased

Build solutions to suit your consumers with a range of credit education tools and resources.

Boost acquisition with trusted Experian products—over 150 million people use our credit solutions.

Activate our easy-to-use digital resource hub to help consumers expand their credit knowledge.

Connect with an Experian Partner Solutions consultant.

Deliver accurate credit data to help consumers meet goals and illuminate new possibilities.

Expand your credit education program to include comprehensive credit reports from all three bureaus.

Differentiate your program by providing FICO® Scores³—the most widely used credit score.

Provide personalized action plans and insights that can help consumers achieve their credit goals.

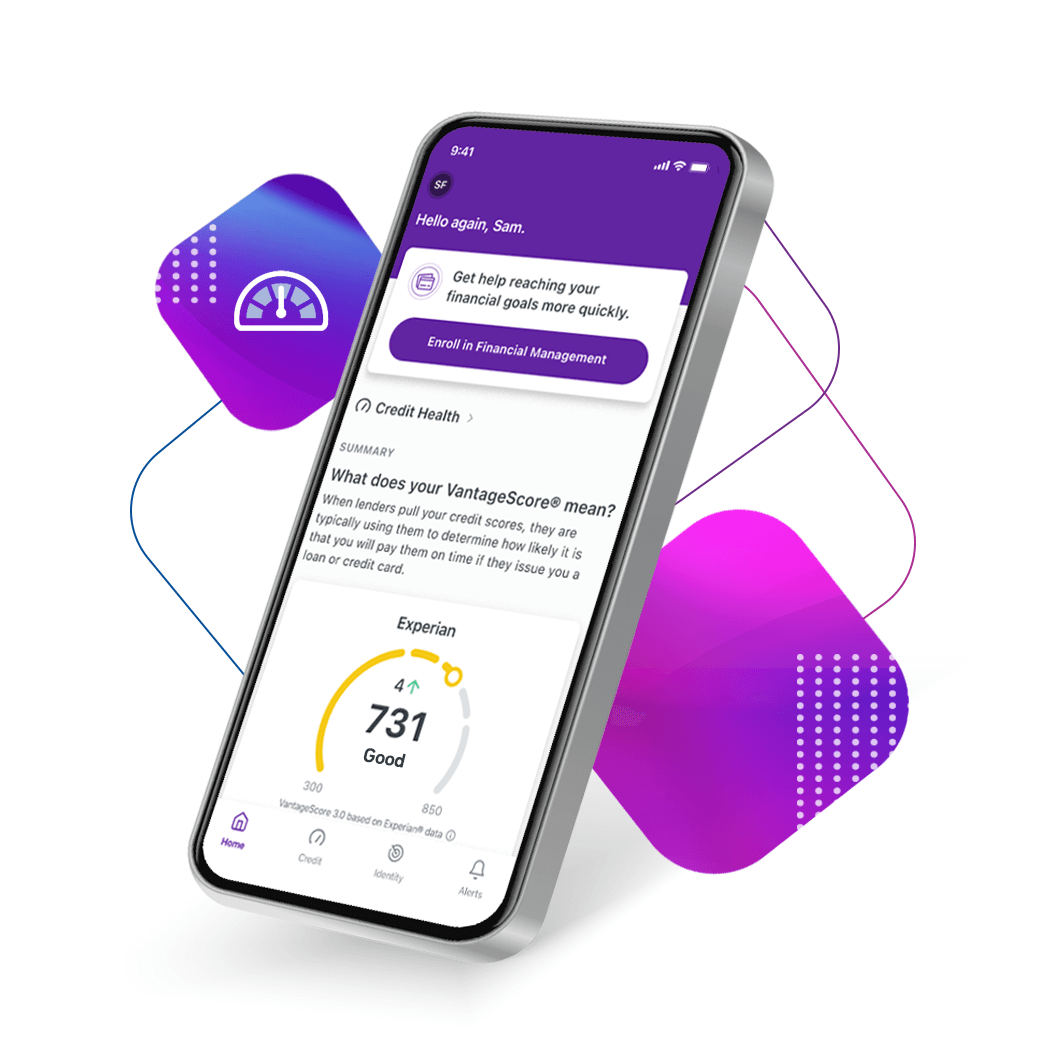

Make your program more inclusive—provide a VantageScore® credit score⁵ that leverages techniques that result in greater accuracy.

Provide consumers a visual history of their monthly FICO® Score³ or VantageScore® credit score⁵ along with score factors.

Estimates a potential FICO® Score³ or VantageScore® credit score⁵ based on personalized financial scenarios.

Learn how a trusted national retailer tripled their portal login rates, achieved a 300% boost in monthly upsells and maintained 0% member attrition with Experian Partner Solutions⁶.

Seamlessly integrate Experian products into your existing systems for a streamlined customer journey.

Utilize a tailored, fully-hosted solution while leveraging Experian's brand equity.

If you're a consumer with credit questions, visit our Personal Services Contacts page.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

¹Experian data, February 2024

²MX survey, "How to Keep Consumers from Breaking Up with Banks", January 2024

³Credit score calculated based on FICO® Score models. Your lender or insurer may use a different FICO® Score, or another type of credit score altogether. Click here to learn more. Click here to learn more.

⁴FICO® Score Planner results are provided for informational purposes only and are intended to approximate the impact of various actions on your FICO® Score 8 - assuming all other factors stay the same. Your actual score, and the impact of any actions taken, results from a complex interaction of FICO's scoring methodologies and the information on your credit report, some of which changes daily. FICO® Score Planner doesn't consider information from accounts where you are reported as an authorized user.

⁵Calculated on the VantageScore® 3.0 credit score model. Your VantageScore 3.0 credit score from Experian® indicates your credit risk level and is not used by all lenders, your lender may use a score that’s different from your VantageScore 3.0 credit score. Click here to learn more.

⁶Experian partner data, 2024