Average Mortgage Rates by Credit Score

Quick Answer

The current average mortgage rate for someone with a good credit score (700) was 6.61% as of February 2026, according to Curinos data. Your credit scores can directly impact your eligibility for a mortgage and the interest rate you receive. You may need a score in the high 700s (or higher) to get the best interest rate.

The current average mortgage rate on a conventional 30-year fixed-rate mortgage for someone with a good credit score of 700 was 6.61% as of February 2026, according to Curinos data. You generally need a credit score of at least 580 to qualify for a mortgage, and a score of 760 or higher to get the best interest rate.

Mortgage Rates by Credit Score

| FICO® Score | 30-year Conventional | 15-year Conventional | 5/6 ARM |

|---|---|---|---|

| 620 | 7.17% | 5.67% | 6.06% |

| 640 | 7.05% | 5.69% | 6.26% |

| 660 | 6.88% | 5.69% | 6.21% |

| 680 | 6.79% | 5.70% | 6.21% |

| 700 | 6.61% | 5.68% | 6.36% |

| 720 | 6.57% | 5.68% | 6.39% |

| 740 | 6.40% | 5.66% | 6.22% |

| 760 | 6.31% | 5.66% | 6.12% |

| 780 | 6.20% | 5.66% | 5.99% |

| 800 | 6.20% | 5.66% | 5.99% |

| 820 | 6.20% | 5.66% | 5.99% |

| 840 | 6.20% | 5.66% | 5.99% |

| FICO® Score | 30-year Conventional | 15-year Conventional | 5/6 ARM |

|---|---|---|---|

| 620 | $1,895 | $2,313 | $1,690 |

| 640 | $1,872 | $2,316 | $1,726 |

| 660 | $1,840 | $2,316 | $1,717 |

| 680 | $1,824 | $2,318 | $1,717 |

| 700 | $1,790 | $2,315 | $1,744 |

| 720 | $1,783 | $2,315 | $1,750 |

| 740 | $1,751 | $2,312 | $1,719 |

| 760 | $1,735 | $2,312 | $1,700 |

| 780 | $1,715 | $2,312 | $1,677 |

| 800 | $1,715 | $2,312 | $1,677 |

| 820 | $1,715 | $2,312 | $1,677 |

| 840 | $1,715 | $2,312 | $1,677 |

Source: Curinos LLC, February 2026; assumes a $350,000 mortgage and 30-day rate-lock period; ARM payments can change after five years

How Credit Scores Affect Mortgage Rates

Your credit score can directly impact your eligibility for different types of mortgages and the interest rate you receive. Generally, a higher credit score can help you qualify for more types of mortgages, a larger loan, a lower down payment and a lower interest rate.

However, unlike when you apply for most loans or credit cards, mortgage lenders tend to request credit scores based on all three of your credit reports and use specific credit scoring models.

Here's a closer look at credit scores and how they can affect your options and rates when you apply for a mortgage.

Compare now: Current Mortgage Rates

Credit Score Basics

A credit score is a number that creditors can use to assess the risk that a consumer will miss a payment by at least 90 days. There are many types of credit scores available, and credit scoring companies like FICO and VantageScore® regularly release new versions and types.

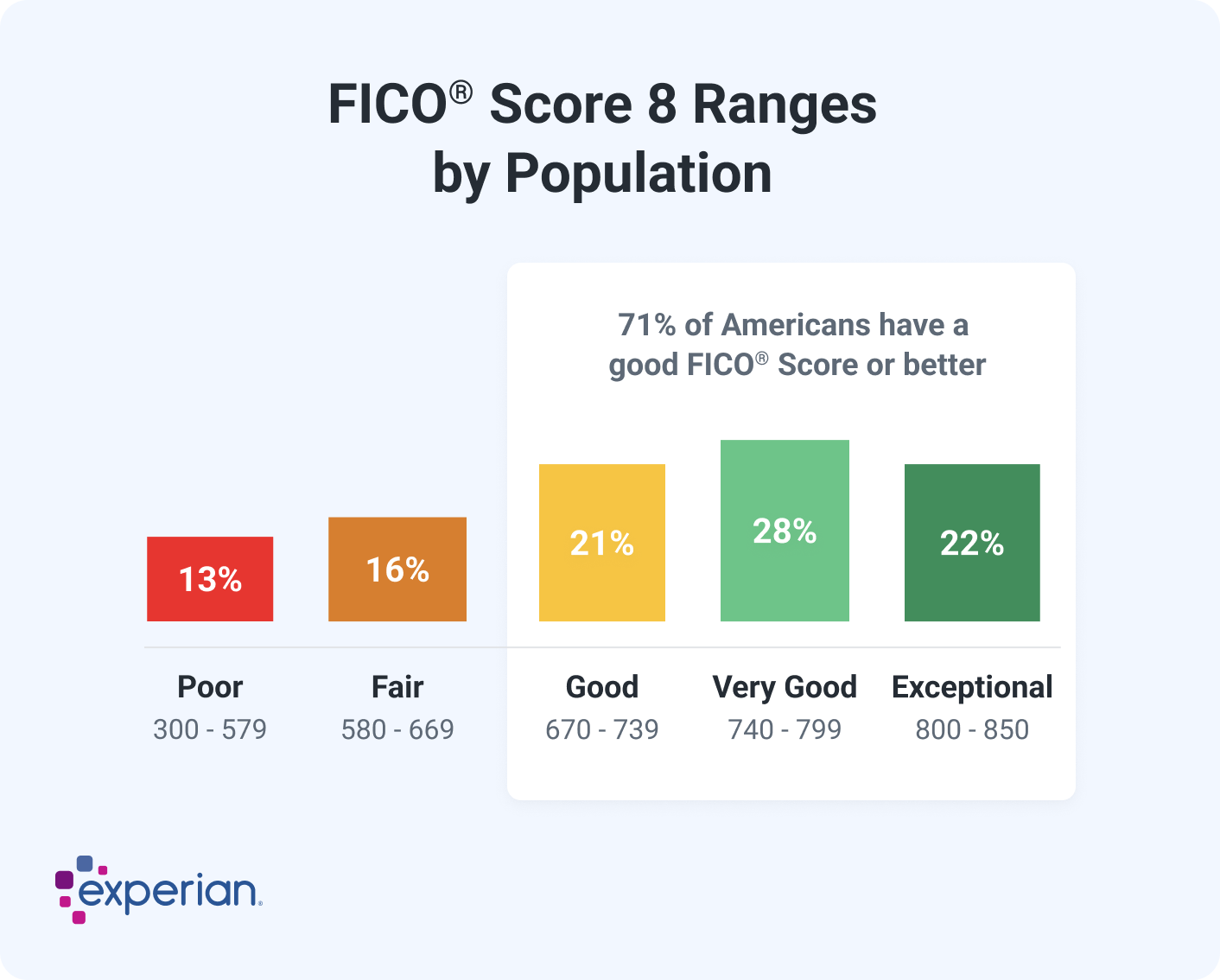

Most credit scores analyze your credit report from one of the major credit bureaus—Experian, TransUnion or Equifax—to determine a score. Many credit scores, including the scores commonly used for mortgages, range from 300 to 850. A higher score is better because it indicates the person is less likely to miss a payment.

Most scores consider similar factors, such as your payment history and credit utilization ratio, but the specific factors and weighting depend on the type of credit score.

Learn more: Credit Score Basics: Everything You Need to Know

How Credit Scores Can Affect Your Mortgage

Lenders consider many factors when reviewing your mortgage application, and there's often a minimum credit score requirement. Once you're above the minimum, a higher credit score could help you qualify for a mortgage with:

- Lower interest rate

- Higher loan limit

- Smaller down payment

- Higher debt-to-income ratio (DTI)

- Lower fees

In short, a higher credit score can make getting a mortgage easier—and cheaper. The most commonly used credit scoring models top out at 850, but you don't need a perfect score to get the best loan offer. Mortgage lenders tend to offer the best rates and terms to everyone who has a score above a certain point, such as 740 or 780.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

Minimum Credit Score Requirements for Different Mortgages

You might be able to get a mortgage even if you don't have a good credit score—or any credit score. But many mortgage lenders have minimum credit score requirements for the various types of mortgages they offer.

The type of mortgage could affect your down payment, maximum loan amount, the home you can buy and the interest rate you receive. Different types of mortgages include:

- Conventional loans: Conventional mortgages are the most common type of mortgage. Lenders issue these loans directly to borrowers, and the loans aren't part of government-backed programs. Lenders can set their own terms, including minimum credit score requirements, but 620 is a common threshold.

- Jumbo loans: Jumbo loans are conventional loans that have a higher balance than the current conventional loan limits for the area. These make them a type of non-conforming mortgage, and they tend to require a higher income and credit score than conforming conventional loans.

- FHA loans: Government-backed Federal Housing Administration (FHA) loans have less stringent requirements than conventional loans. You might qualify for an FHA loan with a 500 credit score if you put at least 10% down. Or, you can put as little as 3.5% down if your credit score is over 579.

- VA loans: Department of Veterans Affairs (VA) loans technically don't have a minimum credit score. However, lenders that participate in the VA program can set their own minimums. A credit score of 620 is a common requirement.

- USDA loans: U.S. Department of Agriculture (USDA) loans similarly don't have a set minimum credit score. However, lenders may require a credit score of at least 580, and you'll need a 640 or higher if you want to go through a streamlined review process.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional loan | 620 |

| Jumbo loan | 700 |

| FHA loan | 500 |

| VA loan | 620 |

| USDA loan | 580 |

Learn more: What Type of Mortgage Loan Is Best?

Mortgage Lenders Generally Use Older Credit Scores

Many mortgage lenders use classic FICO® Scores when reviewing mortgage applications. There are three classic scores, one for each credit bureau:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO Risk Score 04

In October 2022, the Federal Housing Finance Agency (FHFA) announced that mortgage lenders will be required to deliver newer FICO 10 T and VantageScore 4.0 credit scores when selling mortgages to Fannie Mae or Freddie Mac—a common arrangement. There was an estimated implementation timeline for late 2025. But in early 2025, that was revised to a "to-be-determined" date.

Learn more: Which Credit Scores Do Mortgage Lenders Use?

Lenders Consider Your Middle or Lowest Credit Score

A mortgage lender will usually request a tri-merge credit report, which combines information from all three of your reports and includes credit scores based on each report. The lender might use the middle score, or the lower score if you only have two scores, when determining if you meet the minimum credit score requirement.

If you're applying with a co-borrower, the lender might use the lower of your scores. Or, it could use the average median score based on both of your middle credit scores.

What Else Affects Your Mortgage Rate?

In addition to your credit score, lenders consider many factors when determining your mortgage's interest rate. You may be able to affect some of these, such as the type of loan and repayment term. Others could be out of your control or require you to shop around for a mortgage and gather offers from multiple lenders. Here's an overview of these factors.

Your Finances and the Loan's Specifics

- Your DTI: A lower DTI could help you qualify for a lower interest rate.

- Your down payment: Your down payment will determine the loan's loan-to-value (LTV) ratio. A higher down payment results in a lower LTV, which could lead to a lower interest rate. You also may need to pay for mortgage insurance if you don't put at least 20% down on a conventional loan.

- If the home is your primary residence: Mortgage rates can differ depending on whether the home will be your primary residence, a second home or an investment property.

- The loan amount: You might receive a higher interest rate if your loan is especially big or small. A large loan could be riskier for lenders, and a small loan might not be profitable enough if it has a low rate.

- The type of loan: Different types of mortgages tend to have higher or lower interest rates. For example, a VA loan may have a lower rate than conventional loans.

- The type of interest rate: Fixed-rate mortgages tend to start with a higher rate than adjustable-rate mortgages (ARMs), but the ARM's interest rate could increase in the future.

- The repayment period: A mortgage with a shorter repayment period, such as 15 or 20 years, might have a lower interest rate than a 30-year mortgage.

- Mortgage points and credits: You might be able to buy mortgage points to decrease your interest rate or get credits that offset closing costs in exchange for a higher interest rate.

Other Factors

- The lender: All else being equal, mortgage lenders may offer different rates and terms on their loans.

- Market forces: Current market conditions, including inflation rates and bond rates, could affect mortgage rates in general.

- The home's location: A home's location generally won't have a major impact on your interest rate, but it could be a factor.

Mortgage calculator

How to Improve Your Credit Score

There are many potential ways to improve your credit scores. The specifics will depend on what's affecting your credits cores today, but make an effort to:

- Pay your bills on time. Avoiding late payments is one of the most important things you can do to maintain a good credit score and improve your credit scores over time. Set up payment reminders or automatic payments to help you stay on top of due dates. If you miss a payment, bringing your account current before the bill is 30 days past due could help you keep a late payment from hurting your credit scores.

- Lower your credit utilization rate. Your revolving credit utilization rate can be an important scoring factor. It depends on the balance and credit limits of your revolving accounts as they appear in your credit report, not your online account. Paying down credit card balances and making early credit card payments might help lower your utilization rate, which could quickly improve your credit scores.

- Keep your credit cards open. You don't necessarily want to keep a credit card open if it has an annual fee or if you tend to overspend. However, keeping unused credit cards open can increase your overall available credit and result in a lower utilization rate.

- Review your credit report for information you believe to be erroneous. Information that creditors reported in error, or was reported as a result of fraud, could hurt your credit scores. You have the right to dispute any inaccuracies you find when you look over your credit reports.

- Ask your loan officer about collection accounts. Paying off or settling collection accounts can improve your credit scores with newer credit scoring models, but it might not affect the models that mortgage lenders use. Open collection accounts could affect your application in other ways, so work with your loan officer or broker to figure out the best way to handle outstanding collections.

You may also want to hold off on applying for new credit cards or loans if you're looking for a mortgage. Each application can lead to a hard inquiry and new accounts can lower the average age of your credit accounts—both of these could hurt your credit scores a little. The additional monthly payment could also increase your DTI, which could make it harder or more expensive to get a mortgage.

Next Step: Get Preapproved

Getting preapproved for a mortgage can show you estimated loan offers based on your credit, finances and desired loan terms.

Unlike a prequalification, which generally only requires you to share some estimated figures, a mortgage preapproval is similar to an actual mortgage application. You may need to share copies of your tax forms, pay stubs, financial statements and agree to a credit check.

Although it can require some upfront work, getting preapproved can be an important step in determining whether you can qualify for a mortgage and the interest rate you'll receive. Lenders also generally require similar documents, so it could be relatively easy to get preapproved with several lenders once your documents are in order.

If you're preapproved, the lender will give you a preapproval letter that's good for 30 to 90 days. Including the letter when you put an offer on a home could make your offer more attractive because it shows the seller that you likely won't have trouble getting financing. In competitive markets, sellers might not consider your offer if you don't have a preapproval letter.

Learn more: The Complete Guide on How to Get a Mortgage

Check and Monitor Your Credit Score

You can check your FICO® Score 8 and credit report for free from Experian. Although mortgage lenders don't use this credit score, it could give you a general idea of where you stand. You'll also receive free credit score and report monitoring, which can alert you about important changes. If you want to check one of your classic FICO® Scores, Experian's premium identity theft and credit protection services offer more comprehensive credit and identity monitoring and alerts.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis