How to Get Free Credit Reports From All 3 Credit Bureaus

Quick Answer

Register with Experian to access your Experian credit report anytime for free. You can also get free weekly TransUnion and Equifax credit reports through AnnualCreditReport.com.

Your credit reports contain a detailed record of the credit accounts your creditors report to each bureau, along with some of your personally identifiable information. Reviewing your credit reports regularly is crucial for building and maintaining a strong credit history and protecting yourself against identity theft.

Fortunately, you can access your credit reports from all three credit bureaus for free. Here's how you can do it.

How to Get Free Credit Reports

You can access your Experian credit report for free anytime by registering with Experian.

Alternatively, you can get free weekly access to your credit reports from the three national consumer credit bureaus—Experian, TransUnion and Equifax—through AnnualCreditReport.com, a website that's jointly operated by the three credit bureaus.

What to Look for When You Check Your Credit Report

Whether you're working to improve your credit scores, planning to apply for credit or simply wanting to know where you stand, here are some key elements to focus on:

- Personal information: Here, you'll find your legal name and other nicknames and aliases you've provided to lenders, employers, your year of birth, current and previous addresses and other key personal details provided by creditors.

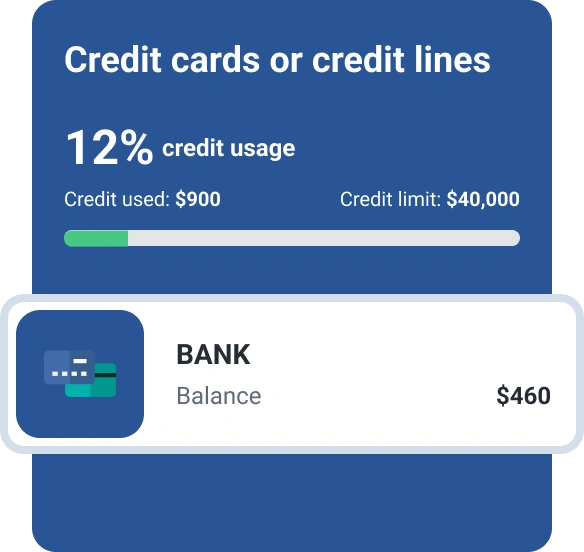

- Credit accounts: You'll be able to see important information on each of your credit accounts (also called tradelines), including account types, original and current balances, payment amounts and payment history, and the dates you opened and closed the accounts. Closed accounts can remain on your credit reports for up to 10 years.

- Inquiries: Each time you apply for credit, the lender will typically run a hard inquiry on one or more of your credit reports. In other instances, a lender, insurance carrier, utility company or other organizations may run a soft inquiry on one or more credit reports. These inquiries will be listed on your credit reports for up to two years.

- Public records: If you file for bankruptcy, this public record will show up on your credit reports for up to 10 years. Bankruptcy is the only public record that appears on your credit report.

How Often Is My Credit Report Updated?

Your credit reports are updated each time a lender or other data furnisher reports information to one or more credit reporting agencies.

Creditors typically report information to the credit bureaus on a monthly basis, but there's no set day when all lenders update this data. In other words, a credit bureau could receive an update from one lender on the first of every month and from another lender on the 15th of every month.

Depending on how many creditors and other data furnishers you have a relationship with, your credit reports could change frequently throughout the month.

Reasons Why It's Important to Check All 3 Credit Reports

It's generally important to review your credit reports before you apply for credit or if you believe you've been a victim of identity theft. But it's also a good idea to check your credit reports at least every few months to stay on top of your credit history. Here's why:

- Ensure all the information is accurate. Occasionally, you may run into information on your credit reports that's been inaccurately reported by your creditors or is the result of fraud. Erroneous information can potentially damage your credit scores, making it difficult to get approved for credit when you need it.

- Identify areas where you can improve. If your credit scores need some work, your credit reports will help you determine which steps you need to take to improve them.

- Get a holistic view of your credit standing. If you're applying for a loan or credit card, checking your credit scores and credit reports can give you a general idea of your creditworthiness and help you evaluate your approval odds.

- Check for discrepancies. Because your credit reports are handled by three separate companies, it's possible for there to be discrepancies between your reports. Reviewing all three credit reports can help you detect issues you may not notice if you're only checking one of them.

How to Fix Inaccuracies on Your Credit Report

If you find a name, a credit account or other information you don't recognize on one of your credit reports, it could be a sign of identity theft. If this happens, you have the right to file a dispute with the appropriate credit reporting agency.

Each credit bureau has its own process for handling disputes. Experian makes it easy to initiate a dispute online through the Experian Dispute Center. You can also initiate a dispute at Experian by phone or mail.

Once you submit a dispute, the credit reporting agencies typically investigate and resolve the request within 30 days. Depending on the results of the investigation, the bureau may update or delete the disputed information or leave it unchanged.

Tip: When incorrect information appears on multiple credit reports, you should submit a dispute with each of the three consumer credit bureaus.

How to Check Your Credit Scores

While your credit reports are the basis of your credit scores, you won't find your score anywhere on your reports.

Fortunately, you can also check your FICO® ScoreΘ based on your Experian credit report for free anytime, making it easier to stay on top of your credit health. You can also access your FICO® Score based on all three of your credit reports for a one-time fee or by subscribing to a premium Experian account.

Checking your credit scores regularly can help you spot early signs of potential issues. If you notice a dip in your scores, taking swift action can help prevent things from getting worse.

The Bottom Line

Regularly reviewing your credit reports can help you build and maintain good credit scores and also identify potential threats to your creditworthiness.

With Experian's free credit monitoring service, you can review your Experian credit report and FICO® Score and also get real-time alerts when changes are made to your report, making it easier to keep track of your credit profile.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben