What Is APR on a Credit Card?

Quick Answer

The APR on a credit card is the annual rate of interest charged on the credit card balance. Credit cards often have several APRs for different kinds of credit card balances, like new purchases and balance transfers.

A credit card APR is the cost you pay when you carry a balance on your credit card. The APR, or annual percentage rate, is an important factor to pay attention to when you're choosing a credit card. Here's an overview of how credit card APR works and why it matters.

What Is Credit Card APR?

A credit card's APR is expressed as a percentage you can use to calculate the cost of borrowing money on a credit card and repaying it over time. As of May 2024, the average credit card APR was 22.76%, according to the Federal Reserve

A credit card APR can be either fixed or variable, though most credit cards have a variable APR.

- A variable APR can fluctuate over time, usually based on an underlying index rate like the Federal Reserve's prime rate. Your credit card agreement describes which index rate is used to determine your card's APR. When the index rate changes, your credit card APR will also change. Your credit card issuer doesn't need to give you advance APR increases resulting from changes in the index rate.

- A fixed APR generally remains constant. If the card issuer wants to increase a fixed APR, they must provide advance notice before the rate increase takes effect.

Interest charges apply to balances carried from one billing period to the next, meaning interest can be avoided if purchases are paid off quickly.

Credit Card APR vs. Credit Card Interest

With loans like a mortgage or auto loan, the APR may be higher than the interest rate. That's because APR includes the interest rate as well as upfront closing costs and other financing fees. With credit cards, however, the APR and interest rate are the same.

Learn more: APR vs. Interest Rate: What's the Difference?

Types of Credit Card APRs

Credit cards apply different APRs depending on the type of transaction; for instance, purchases and cash advances. As a result, your total balance may be subject to different APRs based on the specific transactions you've made.

| Purchase APR | The rate applied to purchases when you carry a balance from month to month. |

|---|---|

| Balance transfer APR | The rate applied to balances transferred from another credit card. The balance transfer APR is often the same as the purchase APR. |

| Cash advance APR | The rate applied to cash withdrawn against the credit limit or cash equivalent transactions. The cash advance APR is typically higher than the APR for purchases or balance transfers. |

| Installment plan APR | The rate applied to purchases you convert to a fixed installment plan, which some cards allow. |

| Penalty APR | The rate applied to your balance if you make a late payment or your payment is returned by your bank. |

| Promotional APR | A temporary low rate charged on specific types of balances, usually purchases or balance transfers, or both. |

Not every credit card carries all APRs. For instance, some credit cards don't have a penalty APR. Similarly, if a credit card doesn't allow cash advances, it won't have a cash advance APR.

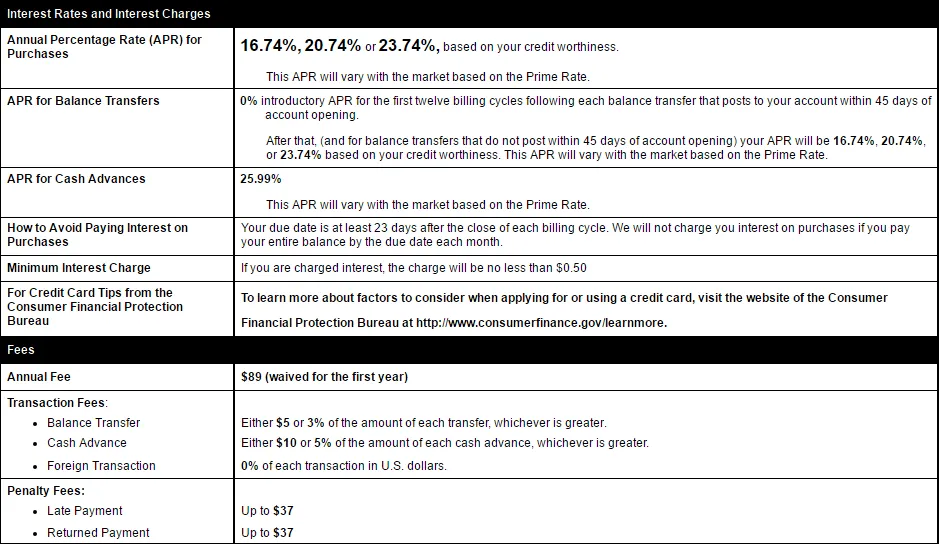

You can find your credit card APRs on your monthly statement. And when you apply for a new credit card, navigate to the issuer's "Rates and Fees" link to find the APRs listed in what's known as a Schumer box, seen below.

Learn more: What Is a Schumer Box?

What Is a Good Credit Card APR?

Generally speaking, a good credit card APR is one that falls below the nationwide average. Since the average credit card APR changes with the market, what's considered a good APR also varies. A lower credit card APR is beneficial because you'll pay less interest when you carry a balance.

A good APR can also depend on the credit card issuer and type of credit card as well. For instance, rewards credit cards and retail credit cards tend to carry higher APRs. Conversely, credit cards from small- to medium-sized banks and credit unions are often lower, but rewards may not be as generous.

When you're shopping for a credit card, compare the APRs of similar credit cards from different financial institutions to find the best rate. A higher credit score could help you qualify for a lower credit card APR.

Learn more: Is There a Limit on Credit Card Interest Rates?

How to Use APR to Calculate Monthly Credit Card Interest

Your credit card APR allows you to calculate the amount of interest you'll pay on your credit card balance. The method your credit card issuer uses to calculate credit card interest can be found in your credit card agreement. Most issuers use either the average daily balance or daily balance method to calculate interest charges.

Average Daily Balance Interest Example

The average daily balance method calculates interest based by averaging out your balance over the billing cycle and is more straightforward.

Credit Card Interest = Daily Rate x Average Daily Balance x Days in Billing Cycle

- Daily rate: The APR divided by the number of days in the year, usually 360 or 365, depending on the card issuer. Using a daily rate is necessary because interest on credit card balances is compounded daily.

- Average daily balance: The sum of your balance each day divided by the number of days in the billing cycle.

- Days in billing cycle: The number of days between credit card statements, usually 28 to 31 days. You can find the length of your billing cycle by reviewing your credit card agreement or a credit card statement.

Let's say you've carried a $1,000 credit card balance at a single APR of 22%. First, we convert the APR to a daily rate by dividing the APR by 365.

- 22 / 365 = 0.0006

Assuming your balance is $1,000 each day of the billing cycle, your average daily balance is $1,000.

Finally, multiply your daily rate by your average daily balance by the number of days in the billing cycle to calculate your interest for the month.

- 0.0006 x $1,000 x 29 = $17.40

The total interest charged for the billing cycle is $17.40.

Daily Balance Interest Example

The daily balance method calculates and adds interest to your balance each day.

- Daily balance: The balance including transactions, interest, fees, payments and credits.

- Daily rate: The APR divided by the number of days in the year.

Let's say you have a $1,000 credit card balance at 22% APR.

First, we convert the APR to a daily rate. We know from the previous example that it's 0.0006%.

Each day, interest is calculated and added to your balance as your balance is multiplied by the daily rate.

Daily Interest = Balance x Daily Rate

Credit Card Interest = Day 1 Interest + Day 2 Interest + ... + Day 30 Interest

| Day | Beginning Balance | New Balance |

|---|---|---|

| 1 | $1,000.00 | $1,000.60 |

| 2 | $1,000.60 | $1,001.20 |

| 30 | $1,017.55 | $1,018.16 |

After adding in the last day's interest, the balance on the last day of the billing cycle would be $1,017.55.

The total interest charged for the billing cycle is $17.55.

How to Get a Lower Credit Card APR

A lower credit card APR makes it easier and less expensive to pay off a high credit card balance. Here are some tips to get a lower credit card APR.

- Raise your credit score. Your chances at getting a lower credit card APR may depend on having a high credit score. Check your credit to see where you can improve.

- Check other credit card offers. Compare your current rate to the APR of any offers you've recently received from other credit card issuers.

- Contact your card issuer to negotiate. With your credit in great shape and competitive APR offers on the table, you're in a good position to ask for a lower interest rate.

- Take advantage of a promotional APR. If your card issuer won't lower your credit card APR, move your balance to a 0% APR credit card. You'll have several interest-free months to pay down your balance.

Learn more: What Can Increase Your Credit Card's APR?

The Bottom Line

Credit card APR directly affects the cost you pay for carrying a credit card balance. Paying your balance in full is ideal for avoiding credit card interest. When that's not possible, a credit card with a low APR is the next best option.

Getting the best credit cards usually comes down to your credit. You can check your credit score for free through Experian before shopping for a credit card to be sure you're focusing on the credit cards you qualify for.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya