Why Is the Credit Card Balance on My Credit Report Different?

You've been working hard to reduce your credit card debt, and recently paid off one of your cards. But when you check your credit report, you notice the credit card account doesn't show a zero balance. Why is this?

The credit card balance on your credit report may be different from the one on your statement because credit card companies typically report to the credit bureaus once a month. Depending on the day you check your credit report, as well as any payments and purchases you made since the credit card issuer last reported, the balance on your credit report may not reflect your current balance or your most recent statement balance.

The statement balance on your monthly credit card statement, which is generated on the last day of the card's billing cycle, includes any purchases, payments and fees during that billing cycle. Your current balance is different; it's a running tally that reflects how much you owe on that particular day. Depending on your card payments and purchases since your last billing cycle closed, your current balance may differ from your most recent statement balance.

When Do Credit Card Companies Report Balances?

Credit card companies report your credit card usage to the three major consumer credit bureaus—Experian, TransUnion and Equifax—after each billing cycle. The frequency may vary a bit, since each credit card issuer has its own reporting schedule, but you can generally expect your credit card activity to be reported to the credit bureaus every 30 to 45 days. Whenever new information is reported, your credit report is updated and your credit score may change as a result.

When you check your credit report, you may notice a balance on a credit card that you recently paid in full. That's because your credit report lists the balance that was on your credit card when the credit card company last reported to the credit bureau. Because reporting typically happens at the end of a billing cycle, you're likely to see the balance that appeared on your last monthly statement.

If you have a new credit card, the balance may not appear on your credit report at all. Generally, a new credit card won't show up on your credit report until 30 to 60 days after you opened the account. (This may vary depending on the credit card issuer and when the card's billing cycle ends.)

If you're trying to reduce your credit card balances before you apply for a loan, you might want your credit card account to show a zero balance on your credit report. The only way to accomplish this is to pay the balance in full and not use your credit card for the following month. At the end of the next month, your credit card company will report the zero balance to the credit bureaus, and your credit report will reflect your account's paid-off status.

How Do Credit Card Balances Affect Your Credit?

To avoid incurring interest on your credit card, you must pay your statement balance in full every month. Otherwise, whatever portion of the statement balance you don't pay will carry over to the following month and will begin to accrue interest.

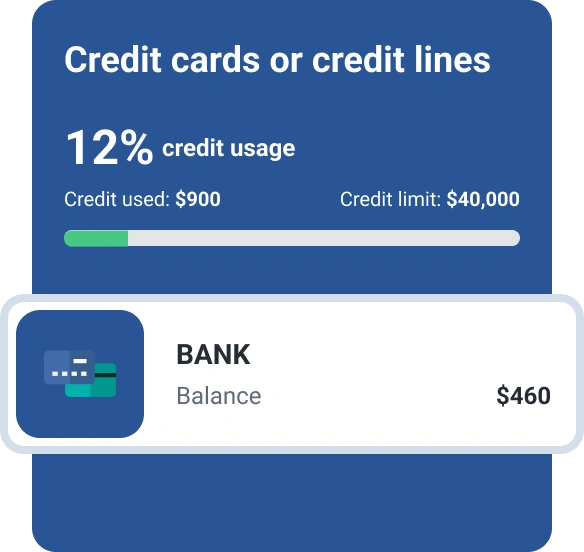

In addition to racking up interest, carrying a balance on your credit card might lower your credit score by increasing your credit utilization ratio. This ratio measures the amount of revolving credit you're using compared with the total amount available on each account and across all your accounts. If your credit utilization rate goes over 30%, your credit score may drop.

How does credit utilization work in practice? If you have three credit cards, each with a $5,000 credit limit, you have $15,000 in total available credit. You could use up to $4,500 of your total available credit and still be within the 30% range for overall credit. You could also carry a balance of up to $1,500 per card and remain within the 30% range for each account. If you carry a $2,500 balance on one card, however, you'd be using 50% of that card's available credit, which could hurt your credit score.

You can reduce the impact of high credit utilization on your credit score by ensuring none of your card balances cross the 30% threshold. In addition, if you have old credit card accounts you no longer use, keeping them open can help reduce your overall credit utilization by increasing the amount of credit available to you.

How to Dispute Inaccurate Credit Report Information

If you believe there is inaccurate information on your credit report that could be hurting your score, you can dispute it with the credit bureau on whose report the information appears. Filing a dispute does not itself affect your credit score. However, correcting inaccurate information or adding missing information that positively reflects on your credit usage may help improve your credit score.

You can get a free copy of each of your credit reports from the three national credit bureaus at AnnualCreditReport.com. If you review your reports and find information you believe is incorrect, you'll need to dispute it separately with each credit bureau that has the information. Each credit reporting agency has its own process for filing disputes, so you'll need to check the specific one to find what steps you need to take.

You can file a dispute with Experian online, by phone or by mail. Once you've filed a dispute, you'll receive notifications of the progress of the dispute and its final resolution.

Keep an Eye on Your Credit

Get into the habit of monitoring your credit card balances and regularly reviewing your credit report. By checking that your statements are correct and confirming that your credit information is reported to credit bureaus accurately, you can help build and protect a good credit score.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen