Boost subscriber loyalty with expanded payment terms

Augment your buy-now-pay-later offers with sophisticated credit risk analysis, increasing conversion rates, reducing bad debt losses, and driving up consumer satisfaction.

Real-time eligibility

Subscriber requests for a BNPL loan through a carrier or marketplace website or app/e-wallet are evaluated and adjudicated in real-time, extending credit at the consumers’ moment of need.

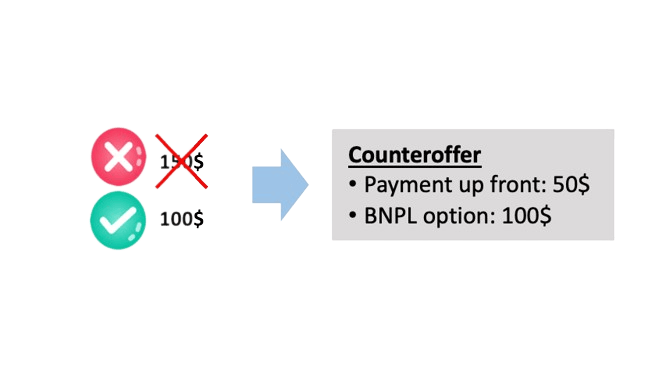

Counteroffers for Risky Borrowers

When a subscriber applies for a BNPL loan and their credit risk is deemed too high, Experian MicroAnalytics will generate an alternative offer for the carrier.

This allows consumers to have the most change to secure a BNPL loan while maintaining the credit risk exposure of the carrier and its lending partner.

Boost conversion rates

For larger purchases, being able to secure a BNPL loan drives higher purchase volumes and happier subscribers.

Manageable credit risk

With Experian's advanced analytics technology, we score each user and structure offers that tailored to their specific risk and opportunity. This ensures higher repayment rates for the BNPL lenders.

Improve loyalty

BNPL loans help subscribers break down payments into manageable installments, increasing consumer satisfaction, improving loyalty and reducing churn.