Unlock financial opportunities and improve financial inclusion

Mobile money loans extend credit to subscribers at their moment of need:

- Predictive real-time risk scores for each subscriber

- Offering the right loan option for each subscriber

- Multiple active loans supported up to credit limit

- Automated loan disbursement to customers' mobile wallet

- Available for prepaid and post-paid users

- Compatible with any e-wallet

- Direct consumer requests or proactive offers based on insufficient funds events

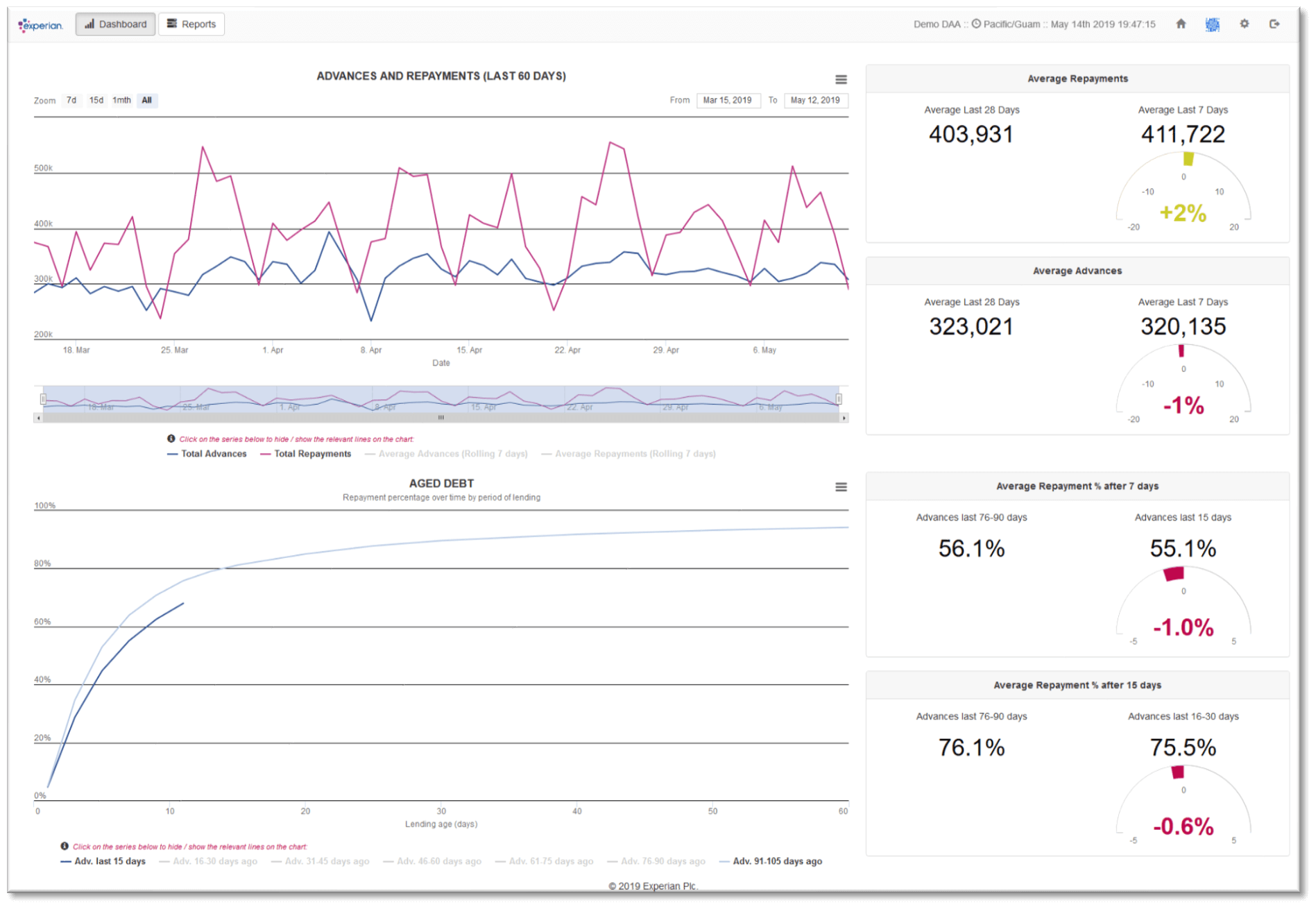

Comprehensive Monitoring Systems

Experian provides a set of comprehensive reports and system monitoring services, displaying key performance indicators for commercial and operational signals, such as:

- Credit extended and total risk exposure

- Payment performance by subscriber and customer segment

- Bad debt vintage charts

- System uptime performance and responsiveness

These services ensure the business goals established for the lending service are being adhered to operationally, while also ensuring the lending service is performing at superior levels of reliability and responsiveness.

Experience our Hassle-Free End-to-End Service!

The full end-to-end service from Experian offers a comprehensive solution for network operators that includes managing the entire service setup process, subscriber communication, collections/disbursements, and many other services.

The best part? It's all done without additional costs, helping operators save time and money while providing a seamless experience for their subscribers.

Flexible Delivery

Our service provides loan offers directly to your subscriber base when they need them the most. While SMS is the defacto communication protocol, we can also integrate our offerings into other communication channels such as WhatsApp, Telegram and USSD.

Regardless of the communication channel chosen, messages include:

- Insufficient funds notifications in their e-wallet, together with instant loan offers

- Loan request forms

- Payment information

- Custom campaigns

Improve ARPU

Mobile money loans expand operator offerings to subscribers, providing carriers with new sources of revenue for their business.

Enhance e-wallet usage

When subscribers are frustrated by insufficient funds in their eWallet, Mobile Money Loans automatically triggers loan offers to the subscriber at their moment of need (assuming appropriate credit risk terms).

Control bad debt

Experian MicroAnalytics effectively balances consumer credit risk with loan portfolio risk exposure, enabling the greatest possible customer adoption while maintaining strong financial controls for the operator.