Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

11 resultsPage 1

eBook

eBook

Instead of relying on reactive, fragmented data, financial institutions need streamlined, governed and integrated feature development capabilities to accelerate model development and enhance transparency.

Experian Feature Builder provides:

Read our latest e-book to discover how your organization can transform raw data into custom, high-value features quickly and easily.

eBook

eBook

Lending institutions can gain an edge on the competition by determining what happens when a loan gets booked elsewhere. With loan loss analysis, lenders can learn more about where these lost loans are booked, the average loan amount, the interest rate, the loan term length, and the average risk score.

Analyzing this information can help lenders:

Infographic

Infographic

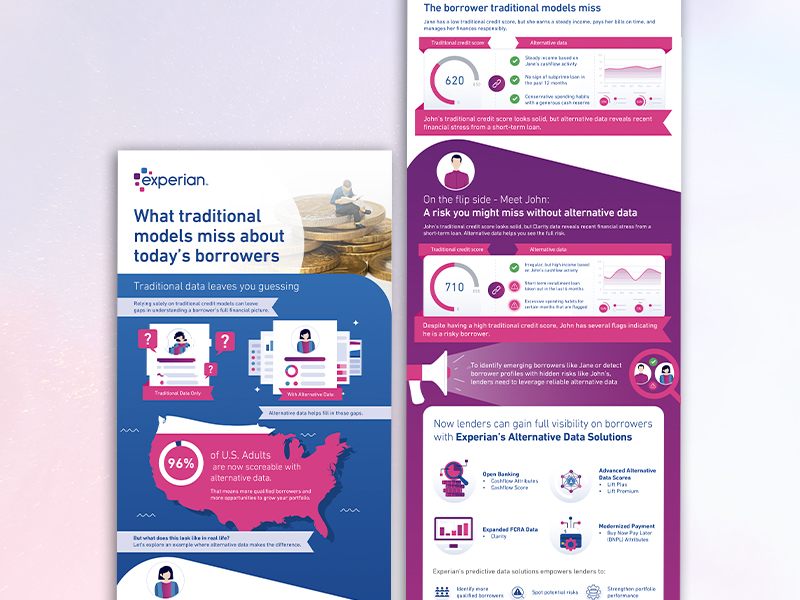

Relying solely on traditional credit scores can leave you with a limited view into consumers’ financial stability.

See how integrating alternative data can help you:

Video

Video

Learn how Experian's Retention Triggers can alert you when your customers shop for new credit or improve their credit standing.

By leveraging this solution, you can then:

Webinar

Webinar

Maintaining accurate voter registration lists is vital for upholding election integrity and enhancing voter trust. As election agencies strive to keep their records up to date, innovative tools and solutions are being developed to address this ongoing challenge.

Watch our on-demand webinar to discover how agencies are leveraging unique data sources to improve voter list accuracy, reduce wasted resources, and lower election costs for taxpayers.

Case Study

Case Study

Election integrity, accuracy and efficiency are essential to keeping our democracy running, and every organization that administers elections considers this responsibility paramount. Download our case study to learn how two entities used Experian’s data sources to benefit from high address location accuracy with minimal false positives.