White Paper

Published October 20, 2015

Commercial Commercial InsightsWhen attempting to determine a small business's credit risk, which is more useful, the company's credit history or its owner's? For decades, conventional wisdom has held that a business owner's personal credit history alone can be used to judge his or her company's creditworthiness. Many lenders have tended to see small businesses and Small Business owners as one and the same, their funds so frequently commingled as to make the two entities virtually indistinguishable. However, this strategy is not always successful. A business owner with good personal credit still can have a failing company, and someone whose personal credit is messy still can own a successful business. Since a bad call can cost a creditor thousands, perhaps tens of thousands, of dollars, Experian® decided to test the conventional wisdom for itself.

Complete the form to access the white paper

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Video

Video

Rising Delinquencies Signal Growing Risk in Transportation & Warehousing

As the U.S. economy continues to recalibrate post-pandemic, the transportation and warehousing segments of the logistics sector are signaling caution. While the broader logistics industry has remained in expansion mode, Experian’s latest Commercial Pulse Report reveals that delinquencies are rising—an early warning of growing risk in two of the economy’s most critical subsectors.

Check out the full report to see how these trends could impact your strategy!

Video

Video

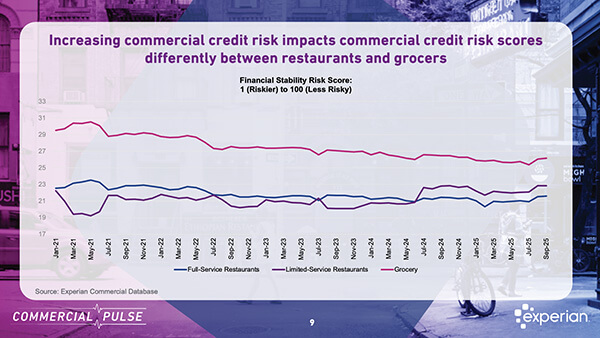

Under Pressure: How Rising Food Costs Are Changing Restaurant Credit Behavior

Experian’s latest Commercial Pulse Report dives into the financial health of the restaurant sector amid rising costs and shifting consumer behavior.

Key insights:

- Menu prices at Full-Service Restaurants rose 4.6% in August — outpacing inflation.

- Limited-Service Restaurants are showing improved credit risk scores, suggesting stronger adaptability.

- Credit access is tightening across the board, with average credit limits falling below $6,000.

- Revolving credit utilization is climbing — an early signal of potential cash flow strain.

What does this mean for lenders and decision makers?

✅ Not all restaurant types face the same risks.

✅ Segmenting credit strategies is more important than ever.

✅ Watch utilization and inquiry trends closely — they may be early indicators of distress.

Check out the full report to see how these trends could impact your strategy!

Video

Video

Credit Signals in Construction: Early Warnings for Lenders and Risk Leaders

The construction industry has experienced significant growth over the last seven years, but fresh data reveals mounting signs of financial stress that commercial lenders and Chief Risk Officers should be closely monitoring.

Check out the full report to see how these trends could impact your strategy!

Video

Video

How Small Businesses Have Changed Since the Pandemic

According to Experian’s latest Commercial Pulse Report, business formation remains strong:

- 471,000 new business applications were filed in July alone

- Between 2018 and 2023, the number of new businesses establishing commercial credit rose by 38%

- New businesses today look more financially stable than those from earlier years

What’s driving this resilience?

👉 Faster tech adoption

👉 Hybrid business models

👉 Stronger financial fundamentals

The pandemic forced small businesses to transform at record speed. Now, they’re leveraging those lessons to build smarter, more adaptable enterprises.

Check out the full report to see how these trends could impact your strategy!