Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

35 resultsPage 1

Video

Video

Fraud doesn’t happen in silos — and neither should your defense.

Watch this product demo to see how Experian’s connected fraud prevention solution brings behavioral analytics, identity verification and digital intelligence together to:

Video

Video

As the U.S. economy continues to recalibrate post-pandemic, the transportation and warehousing segments of the logistics sector are signaling caution. While the broader logistics industry has remained in expansion mode, Experian’s latest Commercial Pulse Report reveals that delinquencies are rising—an early warning of growing risk in two of the economy’s most critical subsectors.

Check out the full report to see how these trends could impact your strategy!

Video

Video

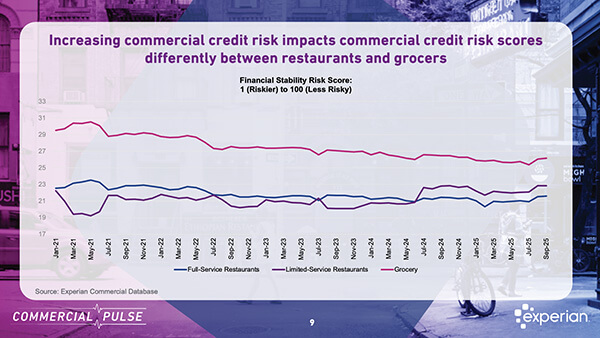

Experian’s latest Commercial Pulse Report dives into the financial health of the restaurant sector amid rising costs and shifting consumer behavior.

Key insights:

What does this mean for lenders and decision makers?

✅ Not all restaurant types face the same risks.

✅ Segmenting credit strategies is more important than ever.

✅ Watch utilization and inquiry trends closely — they may be early indicators of distress.

Check out the full report to see how these trends could impact your strategy!

Video

Video

A strong credit risk decisioning strategy is crucial for any financial institution looking to stand out from the competition, book more high performing loans, and drive revenue. Lenders can achieve this by implementing next-gen AI technology to:

Watch this video to learn how you can level up your credit decisioning journey across the customer lifecycle with the Experian Ascend Platform.

Video

Video

GenAI is transforming the financial services industry by drastically improving productivity and efficiency. Experian Assistant, our award-winning GenAI solution, can help lending institutions:

Watch this video to discover how Experian Assistant can help your business unlock the full power of your data with less friction and faster results.

Video

Video

Behavioral analytics enables Terrace Finance to stop advanced fraud threats and prevent losses from reaching their partners.

Hear directly from Andy Hopkins, CEO of Terrace Finance:

Video

Video

The construction industry has experienced significant growth over the last seven years, but fresh data reveals mounting signs of financial stress that commercial lenders and Chief Risk Officers should be closely monitoring.

Check out the full report to see how these trends could impact your strategy!

Video

Video

According to Experian’s latest Commercial Pulse Report, business formation remains strong:

What’s driving this resilience?

👉 Faster tech adoption

👉 Hybrid business models

👉 Stronger financial fundamentals

The pandemic forced small businesses to transform at record speed. Now, they’re leveraging those lessons to build smarter, more adaptable enterprises.

Check out the full report to see how these trends could impact your strategy!

Video

Video

Outstanding student loan debt in the U.S. has reached an all-time high of $1.63 trillion, and the ripple effects are being felt far beyond the personal finance arena. This unprecedented debt burden is now shaping the way many small business owners borrow, manage credit, and maintain financial stability.

Check out the full report to see how these trends could impact your strategy!