Understanding your business credit score

How are business credit scores determined?

We collect three types of information regarding your business:

Credit obligation information from your suppliers and lenders

Legal filings from local, county and state courts

Company background information from independent sources, including state filing offices, public records, credit card companies, collection agencies, corporate financial information and marketing databases

This information is combined with data from other sources, including:

Your Experian credit score is calculated by a statistically derived algorithm, designed to determine risk based on multiple factors.

The Experian Business Credit Score, known as Intelliscore Plus℠, helps predict how likely a business is to make timely payments. Unlike personal credit scores, your business credit score is public. This means anyone—potential lenders, partners, or even competitors—can check your company's credit profile at any time.

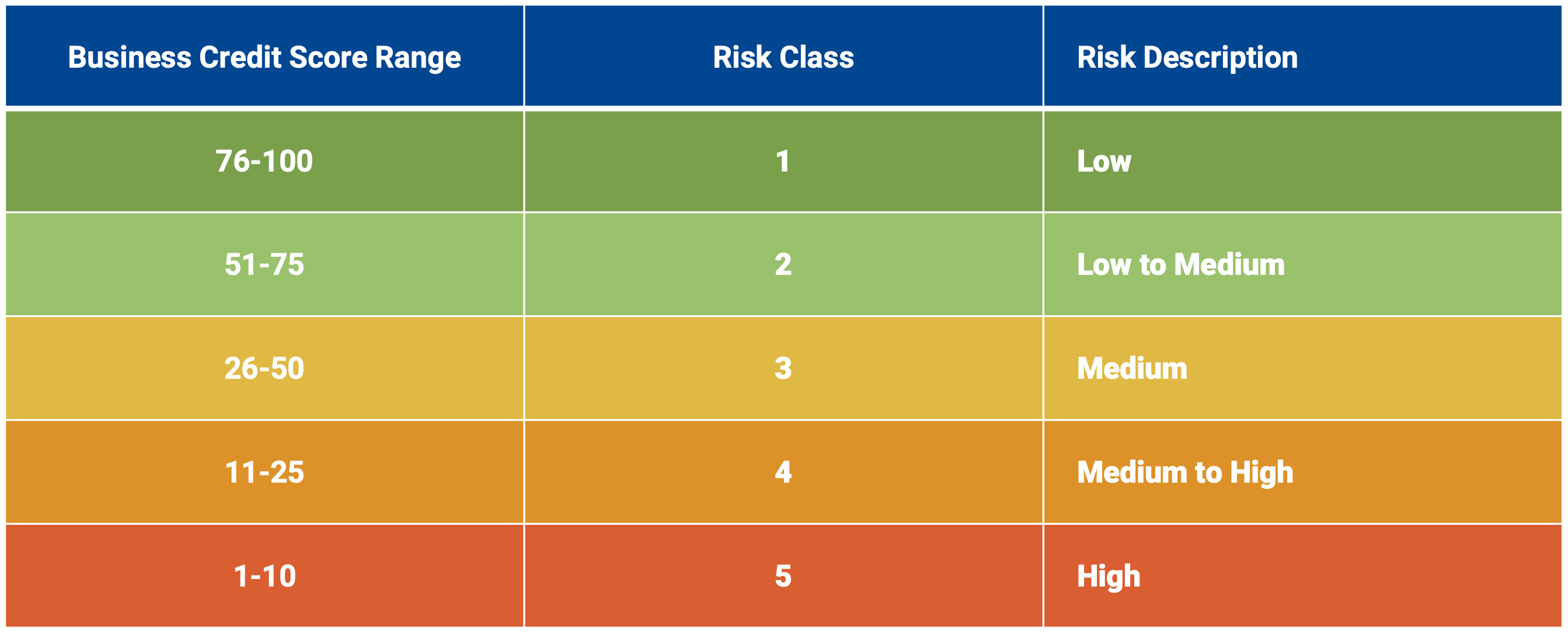

It's important to understand that business credit scores range from 1 to 100. The higher your score, the lower the risk you pose to lenders. Maintaining a strong business credit score can open doors to better financing opportunities and partnerships. Remember, it's not just about borrowing—it's about building trust in the business world.

To learn more about what can impact a business credit score, try Experian's business score planner

U.S., Canada and now international businesses available