Webinar

Published October 6, 2023

Data Quality & ManagementOur expert panel discusses the impact of the end of the student loan forbearance and how leveraging data, scores and credit attributes can help your business better anticipate market trends and align your strategies with consumer behavior.

Complete the form to access the webinar

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

eBook

eBook

Agility & Transparency with Integrated Feature Management

Instead of relying on reactive, fragmented data, financial institutions need streamlined, governed and integrated feature development capabilities to accelerate model development and enhance transparency.

Experian Feature Builder provides:

- Centralized data access

- Advanced lineage tracking

- Streamlined feature registry

- Key statistical reporting

- Comprehensive feature lifecycle support

Read our latest e-book to discover how your organization can transform raw data into custom, high-value features quickly and easily.

eBook

eBook

Win More Business and Minimize Risk with Loan Loss Analysis

Lending institutions can gain an edge on the competition by determining what happens when a loan gets booked elsewhere. With loan loss analysis, lenders can learn more about where these lost loans are booked, the average loan amount, the interest rate, the loan term length, and the average risk score.

Analyzing this information can help lenders:

- Improve lead quality

- Target the right consumers

- Acquire more high-quality loans

- Increase cross-sell opportunities

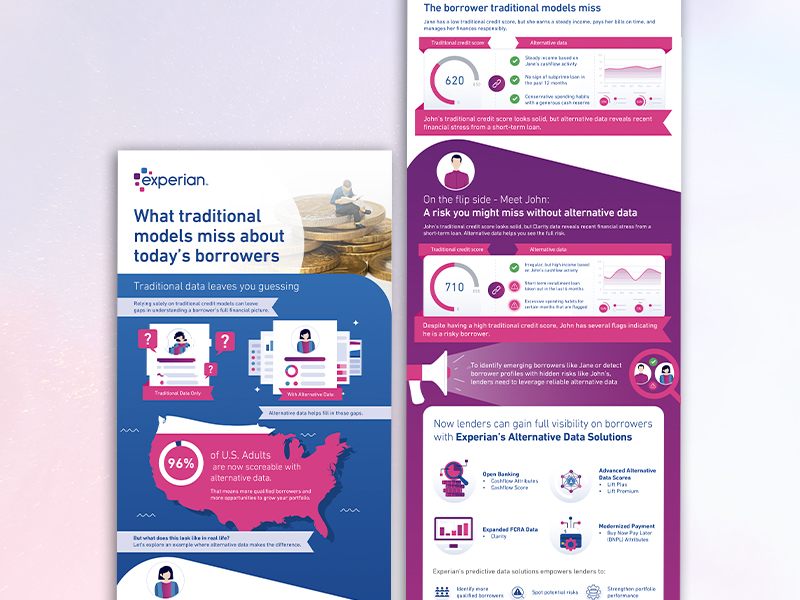

Infographic

Infographic

What traditional models miss about today's borrowers

Relying solely on traditional credit scores can leave you with a limited view into consumers’ financial stability.

See how integrating alternative data can help you:

- Identify more qualified borrowers

- Spot potential risks

- Strengthen portfolio performance

Video

Video

Retain and reward your best customers

Learn how Experian's Retention Triggers can alert you when your customers shop for new credit or improve their credit standing.

By leveraging this solution, you can then:

- Make the right offer at the right time

- Prevent attrition

- Increase customer lifetime value