What Is a Fair Credit Score?

Quick Answer

A fair credit score is generally a FICO Score of 580 to 669. While this is considered a low credit score, you can take steps to improve your score.

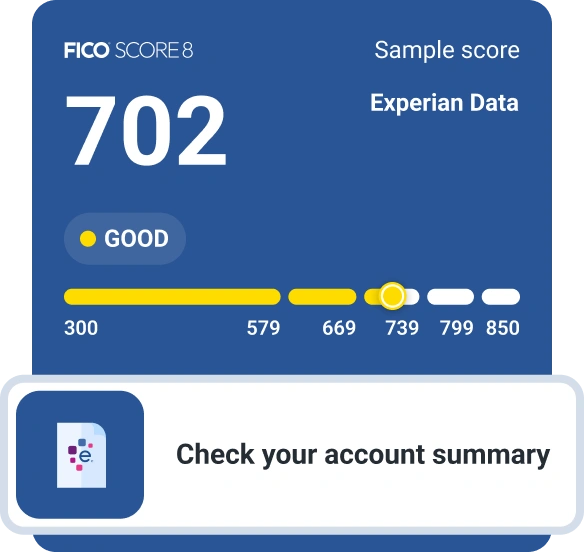

A fair credit score is generally considered to be a FICO® ScoreΘ of 580 to 669 or a VantageScore® credit score of 601 to 660. Credit scores often range from 300 to 850, which puts a fair score in the middle of the scoring range. However, the average FICO® Score was 714 in 2022, according to Experian. If you have a fair score, you may qualify for many financial products, but you likely won't receive the best rates and terms.

What Is a Fair Credit Score?

Fair credit scores are scores that fall within a certain range—580 to 669 for FICO® Scores and 601 to 660 for VantageScore credit scores. The fair range is above poor credit but below good credit, and it aligns with the subprime score range.

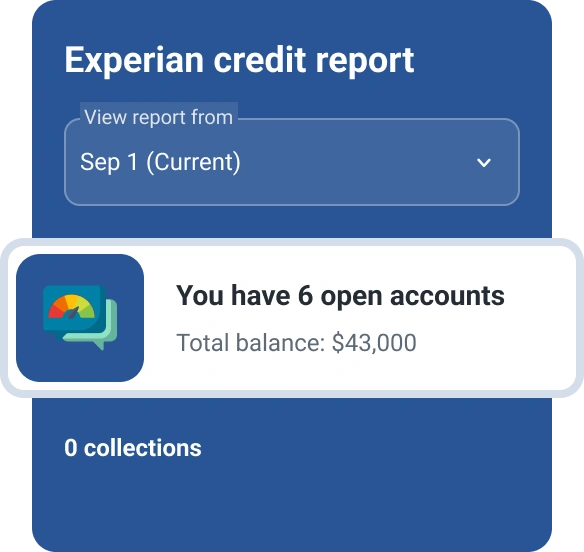

You may have many credit scores, and those scores will depend on the scoring model and which of your three credit reports it analyzes. Although your scores will generally be different, you may find they tend to be within similar score ranges or categories.

Here's a closer look at what the different scoring categories mean:

| Credit Score | Rating | Impact |

|---|---|---|

| 300-579 | Poor | Credit applicants may be required to pay a fee or deposit, and applicants with this rating may not be approved for credit at all |

| 580-669 | Fair | Applicants with scores in this range are considered to be subprime borrowers, meaning their credit standing is less than what is normally desired |

| 670-739 | Good | You may qualify for many financial products, but you could have to pay additional fees and receive average interest rates |

| 740-799 | Very Good | Applicants with scores here are likely to receive better than average rates from lenders |

| 800-850 | Exceptional | Applicants with scores in this range are at the top of the list for the best rates from lenders |

A higher score means that someone is less likely to fall behind on one of their bills than a person who has a lower score. That's why a higher score is better and can help you qualify for more favorable rates and terms.

If you want to take a closer look at the relationship between score ranges and risk, you can use the interactive VantageScore RiskRatio tool. It's intended for lenders rather than consumers, but you can clearly see how a higher score corresponds with a lower chance that someone will become 90-plus days past due on a bill—the specific risk that credit scores measure.

Is It OK to Have a Fair Credit Score?

As the name implies, a fair credit score is OK—but not great. If you have a fair score, lenders may consider you to be a subprime borrower and charge you more upfront fees and higher interest rates. You might even have trouble getting approved for certain financial products.

You're not alone: 28.7% of people had a subprime score in 2022, according to Experian data. Improving your credit scores can take time, but it's best to start as soon as possible because having a high credit score can help you:

- Qualify for more loans and credit cards. Creditors may have required a minimum credit score for certain products. For example, you might need a higher credit score to get the best rewards cards or certain types of mortgages.

- Get lower interest rates and higher credit limits. Your credit score can affect your interest rate and credit limit (or loan amount) on loans, credit lines and credit cards. A higher score can help you qualify for the best possible offers.

- Pay lower (or no) upfront fees. Many personal loans have an origination fee that's a percentage of the loan amount. You might receive a lower fee—or qualify for a loan without a fee—if you have a higher credit score. Similarly, you might need a better credit score if you want to qualify for a mortgage with a low down payment.

- Have more rental opportunities. Landlords and property managers may also require a minimum credit score. Or you might have to pay a larger security deposit if you have a fair credit score.

What Affects My Credit Score?

Credit scores depend on the information in one of your credit reports, and different things can either help or hurt your score. Generally, credit scoring factors are put into five groups:

- Your payment history: This notes whether you've made your payments on time, missed payments, had accounts sent to collections or filed for bankruptcy. These can all have a major effect on your credit scores, and this is often the most important category.

- How you're using credit: Your current credit usage is also an important factor. The remaining debt compared to the original balance on your loans can affect your scores, and your credit utilization ratio—which compares balances and credit limits on revolving accounts such as credit cards—is also an important factor.

- Your experience with different types of credit: If you have a mix of revolving and installment credit accounts, such as a credit card and a loan, that can help your credit scores.

- How long you've used credit: A long history of credit usage, measured by the age of the accounts in your credit report, can also help your credit scores.

- Recent new credit activity: New credit applications might hurt your scores a little, but it's generally a temporary setback if you can make on-time payments and keep your credit card balances low once you open an account.

These five categories can help you remember what affects your credit scores, but there are also multiple specific factors within each category. For example, the average age of your credit accounts, the age of your oldest account and the age of your most recently opened account can all be factors within the age-related category.

How to Improve a Fair Credit Score

If you have fair credit, you may be new to credit or have negative marks in your credit history that are hurting your credit scores, such as late payments or charge-offs. Although you can't remove accurate negative information from your credit report, its impact will usually diminish over time.

You can also look for ways to improve your credit score while you wait:

- Pay all your bills on time. A long track record of on-time credit card and loan payments can help your payment history. Don't miss other payments, either, as past-due accounts could be sent to collections and hurt your credit.

- Consider opening credit-builder accounts. If you don't have any open and current credit accounts—or if you only have a couple of accounts—you might want to open a new credit card or a credit-builder loan.

- Boost your credit. Use Experian Boost®ø to add on-time payments for utility, phone, streaming service and rent payments to improve your credit without opening a new account.

- Pay down credit card balances. Particularly if you're carrying a large balance relative to your card's credit limit, paying down the balance (which will lower your utilization ratio) might quickly help your scores.

- Review your credit report for errors. Closely review the information in your credit reports. If you spot inaccuracies, you should contact the lender reporting the information, and you have the right to dispute the items on your credit report.

Everyone's credit is different, but these actions can help most people improve their credit scores over time.

Monitor Your Progress for Free

Check your FICO® Score for free with Experian, and then use your Experian account to continually monitor your credit report and FICO® Score. You can also review the specific factors that are helping or hurting your credit score and create a plan for improving your score. As you build your credit, use Experian's free comparison tool to find out if you're matched with any credit cards or loans based on your credit profile.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis