Sentinel™ Suite

Commercial Entity Fraud

Calculate the probability of third-party application fraud and business identity theft. Score 300-850.

✓ 3rd Party Fraud

✓ Business identity theft

Calculate the probability of first payment default and credit bust out. Score 300-850.

✓ 1st Party Fraud

✓ Credit Abuse

✓ First Payment Default

✓ Never-Pay

Leverage multiple credible data sources to verify business legitimacy and its connection to the owner.

✓ 3rd Party Fraud

✓ Synthetic Fraud

✓ Fictitious Applications

Examine the usage and velocity of identity elements to flag discrepancies and potential fraud.

✓ Synthetic Fraud

✓ Loan Stacking

✓ Fictitious Applications

✓ Account Takeover

Powerful first and third-party commercial fraud scores predict early payment default, credit bust-out, and business identiy theft in commecial accounts. Both machine-learned scores range from 300-850 points with the highest score representing the lowest risk.

Sentinel houses specialized, proprietary attributes that offer unmatched access to consumer and commercial data sources, including Experian's inquiry network, transactional network, and more than 28M+ business records. Sentinel's attribute logic provides real-time insight into applicants' intent and creditworthiness to better evaluate risk.

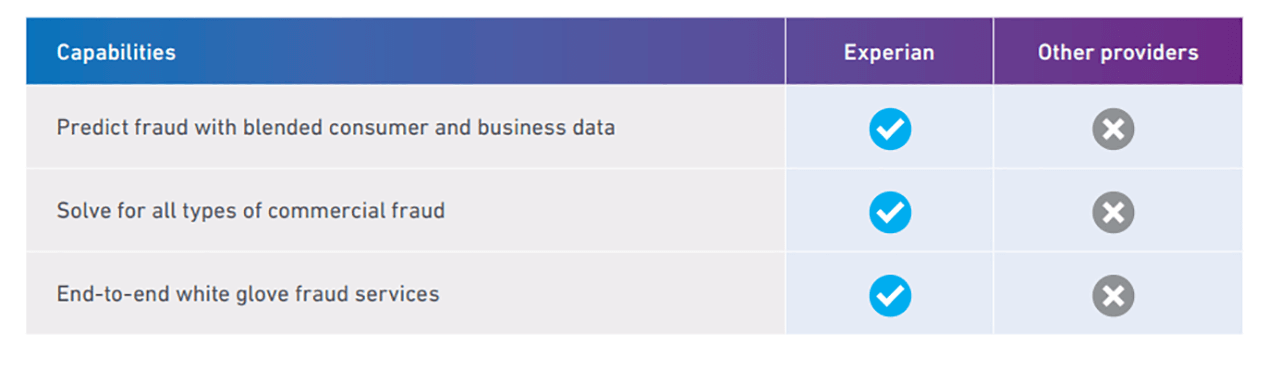

Go beyond single-source verification tools to leverage blended bureau and non-traditional data sources like social and professional networks, historical employment, firmographic data, and more. Combine all this with machine-learned models and scores to provide clients with more insights into their customers.

Configurable via Experian's award winning CrossCore platform, the Sentinel Suite combines powerful decisioning capabilities and robust strategies with default and custom workflows to boost approval times and increase verification efficacy.

Find out how much potential fraud savings the Sentinel™ Suite could provide your organization.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.