Sip and Solve™

Solving business challenges in a coffee break

Modernizing your credit approval process can feel daunting in the beginning stages, but it doesn't have to be. By starting small with some basic automation principals and tips, you can begin to implement change more easily over time in order to drive incremental returns for your business. As you and your stakeholders become more comfortable with these changes and can see the tangible benefits, you can continue to automate more pieces of the process to drive even more value. Eventually, you'll be left wondering why you didn't automate sooner.

We talk through how to:

Over the last four years, I've managed our commercial decisioning suite here within Experian BIS. It's been a great experience, and I was very excited to be approached today about doing this Sip and Solve session, because this is a topic that we do a lot of work with clients on. We see lots of clients from all different walks of automation and all different walks of modernization within their process.

To be able to help on this front is a great opportunity here. So, this is about a 15, 20-minute session. We appreciate you being here. It's a Sip and Solve session. So, it's customary. We hope you have your morning beverage ready.

I here have a nice Dunkin Donuts coffee and a little almond milk. And, of course, I got to drink it out of this daddy shark mug that my daughter gave me for Father's Day. So, if you have kids, you probably know what I'm talking about, but that's a good way to start your day here in the home office.

Yeah. So, I wanted to get right into it and talk to you guys about the credit approval process, and we'll dive right in.

Now, it's important to understand the credit approval process. There's a lot of complexities to it—a lot of moving pieces. But if you were to boil it down to its core function, it's meant to help define and identify risk.

And of course, your definition of risk is dependent upon your business, the types of products and services you work with, as well as your risk tolerance for whatever that definition is. But it also is designed to help facilitate risk-based credit decisions. So, these are fundamental pieces and what we mean by risk-based credit decisions. It's typically based on your risk assessment. You're able to approve those types of low-risk customers and provide your best credit offers to help maximize your profitability. You may also run into situations of medium-risk customers where you will throw some level of caution, slow down the process, and put manual resources into it so that you can determine whether it is an opportunity we want to approve or is some risk that we eventually want to avoid.

Typically, you see declining high-risk customers or facilitating some type of treatment strategy where you hedge your risk against those, whether that's maybe in the trade space, offering cash on demand or COD terms, or potentially moving clients to an introductory offer or credit card, those types of things to help hedge against that risk.

But the reason why I call this out is these 2 pieces, these core functions are important for some of the other concepts. We're going to be discussing here as we go through.

So, if you think about the credit approval process and being the center of our universe, what we typically find is there are market trends and influences, both internally and externally, that impact that credit approval process.

And it's not so much the what that we just discussed, it's more the how. How do I facilitate this process to better accommodate these market pressures or internal pressures within my company, maybe just based on the maturity of my business. And you can see quite a few here. I'm sure none of these shocks a lot of people.

These are standard market trends and drivers that we hear and talk with to our clients about quite often, but I will mention a couple of things or key takeaways about what we're seeing as far as changes. One of which is the concept of maximizing resource efficiency, I would say typically, we saw a lot of larger companies looking at ways to modernize their credit approval process and introduce automation so that they can manage the sheer volume of applications that they were getting, but what we've found is that's moved more into even small and midsize companies where they have resources that wear multiple hats and they're looking for a way to further maximize that capability. But we've also seen a shift in focusing more on sales as well as customer experience being much more driven by those factors.

Ways in which a company can improve their throughput through credit approval, increase their turnaround times, and then impact their customer experience. Some other things to think about, too, is during a lot of conversations with our clients, we talk a lot about being able to improve the workflow process.

Is there an ability for me to take my credit approval process, integrate it with perhaps another system, or integrate it with a set of other processes that are already automated so you can really leverage and maximize those capabilities? So, these are all key market drivers that we typically run into today.

But you find those drivers will impact your path to modernization. And when I talk with a lot of folks in the industry, and I say, if you look at your approach to modernization and where you're trying to go, whether that's the next one year, two years, three years, what did that look like?

And lots of times, I get a response. It feels like the never-ending stairwell. Sometimes I feel like I'm ascending those stairs, but I find myself walking out a door and not really knowing where I am or I feel like I'm spinning my wheels, right? We're not making the progress that we want to despite the perceived effort and what we're doing.

With today's session what we want to do is provide more of a framework that you guys could consider when looking to modernize your credit approval process. Everybody's different, and you can probably argue there are a lot more steps on this depending upon the complexity of what you work with, but based on a lot of best practices that we see today in the commercial credit space, and just a lot of different tools that are being employed out there, we thought this path represented a good starting point that we could help clients with, and help provide some additional input.

And it really is dependent upon where you are in this framework and, ultimately, where that destination is, where you're comfortable, and where you want to go. Your goals will dictate that path. But if we were to take this framework and start at just the basic level, it really starts with credit and risk data; that's still the fuel upon which everything is built, right?

It's the catalyst for all these other pieces and we frequently run into clients today that still rely on manual risk assessment of credit reports and not to say that it's bad or wrong. Over time, you may not be able to support that type of process in your existing business environment.

So, over time, you're going to have to start to change. And what we typically see is a natural progression through these additional steps to help modernize and gain added efficiency. As an example, if I'm just using credit report data, is there a way I can leverage credit scores and analytics to help improve my efficiency or my ability to assess risk?

And if I can do that effectively, is there a way that I can then use some type of auto-decisioning software to action or operationalize those types of risk assessments so that it turns into an action strategy of approve, review, decline, and have it be fully automated for even further efficiency.

And then, if I could get that back-office piece, how we run that credit approval process. Can I link it into my front-end online application process where we can get away from paper or traditional ways of capturing that data? Be able to link everything together to maximize that whole process from start to finish.

And then finally, system integration like we talked about a little bit earlier. Is there a way that I can take that data and take those processes and integrate them into my existing system today or another set of processes to maximize the efficiency and ease of use of it in that fashion?

So, this is a good framework. I highly recommend it. It can be very good at identifying where you are in that process and where you eventually want to go.

I also want to get into a little more detail about each of these steps, and we're going to start out with adopting a credit scoring strategy.

I'm so amazed when I go and talk with some clients who really have not adopted any type of fundamental or base credit scoring strategy, even for just some of the accounts that they work with. And what I mean by that is if you look - and these are clients that traditionally were on manual credit reports, they pull them, they assess them, they must comb through all these data attributes. They have to make sense of what fits into their credit policy. And you can see a lot of inconsistency in the results really across the board, as well as slow turnaround times.

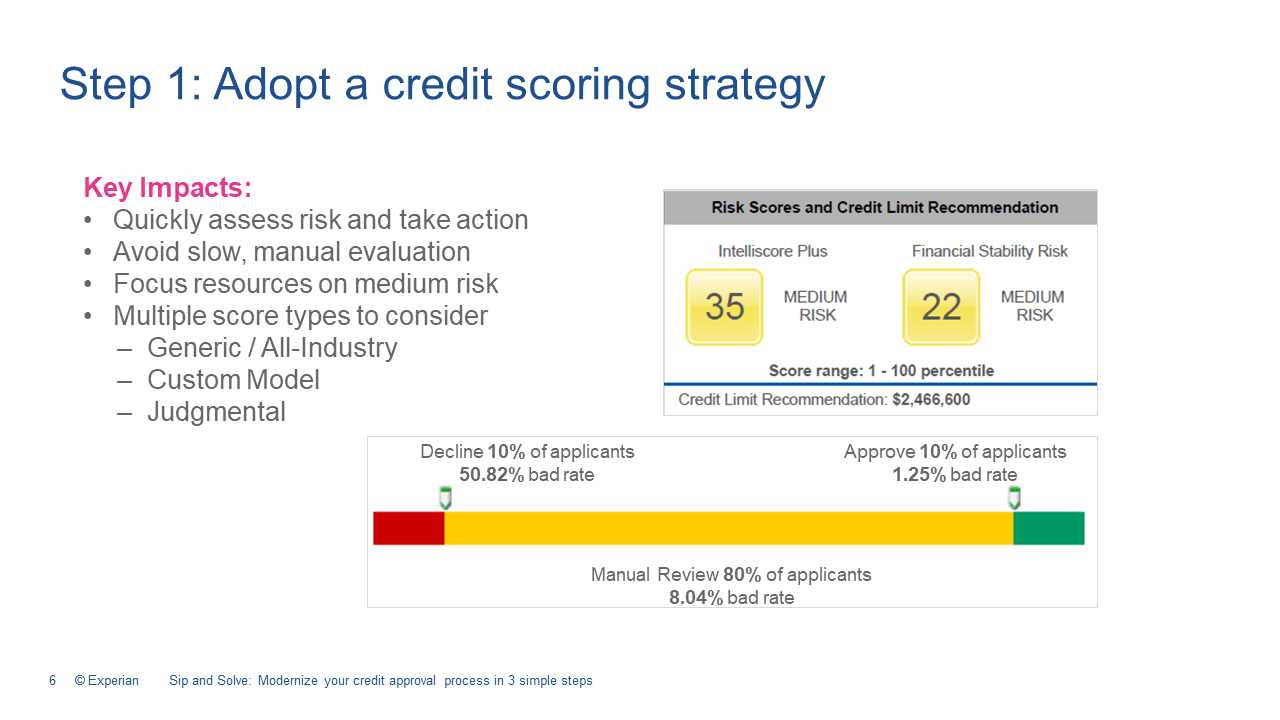

But if you look at this little snippet that I just took off, an Experian credit report as an example. You see what we call all industry or generic scores. These scores are meant to predict the risk of delinquency in our IntelliScore plus model, as well as financial stability risk, which predicts the risk of bankruptcy or default. And you can very easily look at this snippet and say, based on these score values, I have a way to measure what that risk looks like or quantify it, and it's very relatable, and you can start to build processes around it.

We also see things such as default risk classes, like medium risk, or even the ability to put out recommended credit limits to help judge the capacity of credit that you can be able to provide perhaps one of your applicants. This here, just in this little snippet on a base credit report, could save an organization a lot of time when it comes to processing, and hopefully avoid some of that slow manual evaluation.

The other thing to think about, too, is being able to focus your resources. We all know that resources don't grow on trees. I've never encountered someone who said, I have so many resources; I don't know what to do with them. But if you can focus them in on more of those middle-of-the-road type clients that, let's say, in this instance, on the very bottom, 80 percent of your applicant base, and you can look at your lowest risk scores and your highest risk scores and place your auto decline and auto approvals there, what you find in just this scenario, you can help automate potentially 20 percent of your applicant base.

And if you were, let's say, doing 100 applications just as an easy number, you can automate 20 of them and each one took about a half hour to an hour. You can save anywhere from 10 to 20 hours with just this example. So, there are significant cost savings here and resource efficiencies that could be gained by just using a simple scoring strategy.

Always keep in mind, too, this could just act as a starting point. Over time, what we typically see with customers is that they become more used to automation. They go down a learning curve. They feel more comfortable with it. And that middle 80%, where you see that yellow, becomes smaller and smaller.

So, they're able to gain incremental lift in what they're doing. The other thing I wanted to impart to you guys today around scores is I just used the example of a generic score, which we provide as well as many other bureaus and providers also offer in the industry. Still, one of the things you can also look at is modernization within just your credit scoring step or credit scoring strategy.

You could engage a data scientist or an expert modeler. Potentially develop some type of custom model based on your own portfolio performance and the accounts in that portfolio so that it provides even further incremental lift to your day-to-day process, especially when it comes to identifying risk and being able to define it.

The other thing to think about, too, is maybe those don't fit into what you want to do. There are also things around judgmental scoring, which, as the name implies, is more based on your own individual judgment as a credit executive. Are there specific data attributes that you find important to your process that you want to put into some type of score strategy? Can you put weightings around it? Points around it? etc. To create a score that can at least allow you to rank order risk within your portfolio base. So, these are some helpful tips on adopting a credit score strategy that we think could help you on the path to modernization.

If we want to take another step, we could look at putting that strategy into an automated decision policy. And there's some really good software out there in the marketplace today from quite a few providers that would allow you, in essence, to automate the data pull process, whether it's a credit report or perhaps other data attributes you might be looking at, to be able to incorporate scores or even derive your unique scores off of that data set, and in essence, pass them through decision parameters.

So, think about it as a series of if then statements. If my score is 76 to 100, and if we consider it low risk, then approve, and provide the best credit limit offer possible as just a basic example. But that strategy can be executed all in real time and all through an automated decision process. So, you're taking that underlying risk assessment from your credit score strategy, now making it into an operationalized action strategy to facilitate these approved reviews and declines.

By doing this, what you can find is that you're going to turn risk assessment into an action strategy. If you have decentralized processes that typically come out from manual processes where everyone does something a little bit different, you can standardize, and centralize those processes, and the biggest impact, especially on the back office end, is you can reduce your turnaround time and increase your processing capacity, which I think all of us can agree would have a significant impact on our day to day business.

Another thing to consider, too, is a third step, which is to increase your ability to link that back-end piece with your online application process. What do I mean by that? There are some good tools out there that allow you to build and host an online application form. You can do it yourself.

You can build it. You, in essence, create a template and produce a link. And that link could be on your home page, on your website. You could embed it in an email invitation and invite someone to apply for credit. But it creates a real easy way by which a customer or an applicant can go on. Click on that link to apply fill out a credit application online and that can include data attributes that you feel are important to your processing. It can consist of standard terms and conditions. It could include digital signatures, captures, and many different components there. But once that application is submitted, it takes that data. It links it up with your credit scoring strategy and your decision process or your decisioning policy that you have automated on the back end and can render a decision in real time at the point of sale.

And this becomes a real powerful value proposition because not only can you just quickly build and deploy an online form that makes it easier for your customer to interact with you on, it's no longer paper-based, but it helps to automate that full capture, the archiving, the decision. And even messaging it out to your client, whether it's on-screen, via email, or whatever that may be.

And then can render that instant credit at the point of sale. So, if you're concerned about things such as speed to revenue, customer experience, this will help round that out even further as far as your solution set. And what's also nice about this is there are, as I said, quite a few providers that can specialize in this.

Because they host it, there's very little It resources required on your end to deploy something like this, outside of maybe then just embedding a link on your website if that were the case.

Now, one other step I want to talk to you about is more of a bonus step. Is what happens if you already have your online application process? And you have a system that captures it and stores those records? Perhaps it's a CRM system or ERP system. You don't want to recreate the wheel crafts and develop that online application piece. What can you do? One of the things that we see out there and one of the bigger trends, is being able to use API technology to go and create a system integration that can pull out to that credit data we talked about in step 1, the credit scoring analytics, be able to bring in the decisioning service and in essence complement your existing workflow process and be able to perform that credit approval and bring it into your internal system and perhaps kick off a series of other processes or at least store it in a central location that could be easily accessible.

As you go and you look at it, I have some parting thoughts for you, especially if you're at the very bottom of that staircase and you're looking up. My first recommendation is to breathe. You don't think you have to go from zero to 60 in under three seconds and achieve all these different steps to be successful or to start implementing some level of modernization.

Start small, right? And this framework provides a really good way to look at where you are, and where you can potentially go and start with the basics. Look at the credit data. Look at the scores and analytics. Could you put in some decisioning software processes? Maybe get the back-end piece and then bring in the front-end piece for online application processing or perhaps even system integration if you are looking for people or vendors to help you with it, seek out the right partners. Hopefully, they understand where you're starting from they can meet you where you are and take you to where you want to go they have flexibility in their services to help you, and you can dictate how you want to do it as well as the speed in which you want to do it because we all know we all have different levels of comfort with automation here in the process.

That's what I wanted to talk with you guys about today. Hopefully, this spurred some additional thought for you or gave you some other ideas that you can use to help modernize Your existing process today.

Related to this session - we have another 15-minute webinar featuring Marsha Silverman called “Signs You Need To Adjust Your Decision Model.”

With more than 14 years’ experience, Erikk Kropp is a Senior Product Manager with Experian working in Business Information Services. His responsibilities include managing operations and strategy for DecisionIQ. Prior to joining Experian Erikk held both sales and operational positions in the banking and software industry. He has a B.A. from Gettysburg College with a concentration in Business Management and Economics.

We will be scheduling more Sip and Solve sessions. Sign up below to be notified.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.