Unintended harm – is your fraud prevention hurting financial inclusion?

Sip and Solve™ 15-Minute Webinar

We often hear anecdotes from our clients about a recent string of bad debt, soliciting advice on how best to prevent future losses. Typically, with an increase in credit loss, maybe your natural reaction is to tighten up on credit evaluation criteria to screen out look-alikes? In so doing, you can also impact the ability to grow, and in the process, exclude good customers by retooling your lending criteria, weeding out fraud.

In this Sip and Solve session, we'll explore whether tightening your credit score cards could unintentionally cause dozens, hundreds, thousands of small businesses not to receive the credit they deserve.

Session highlights

What follows is a lightly edited transcription of this Sip and Solve talk.

Hi, everyone. Welcome to another Sip and Solve. I'm Li Mao, I'm a Product Manager at Experian and my focus area is commercial fraud. My goal is to help our clients provide a frictionless customer experience for the best customers without sacrificing their ability to identify fraudulent intent. And today I'll be walking you through how you can think about diagnosing your recent string of bad debt, on whether fraud could be the primary culprit, and how you could unintentionally harm your diversity, equity, inclusion goals by not considering fraud as a possibility and your recent string of bad debt.

I have a bottle of water next to me today, and I'll be sipping throughout the session. I hope you have something good in front of you too as well. Since we only have 15 minutes, let's jump right in.

I want to start off with a quick story that many of you could relate to and the end result could happen to you as well if you're not careful and more strategic with your decisioning process. So I really like a certain coffee brand at Costco because I like this taste, this brand. They come around Costco twice a year and you can only get it there. You know, the first few times I try to just buy enough of this coffee, where I finish the bag right around when they come around the second time. But it never really quite works out that way because there's always a few weeks where I don't get my special coffee. One time I had this “Eureka” moment thinking, “Hey, I'll just buy this their largest bag because that for sure will last me a long time, but like anything else that you buy at Costco, unless you can consume it fast enough, it's probably going to go bad. And that's exactly what happened here. The flavor changed towards the end and it ruined the coffee for me. You also had to buy all these extra accessories to store all the additional coffee that I have now have. So, I'm telling this story because I've seen many clients take this approach with their risk assessment. What we thought initially was a good decision, a good time when you're adjusting your scorecard, really came all these unintended side effects, making things go bad.

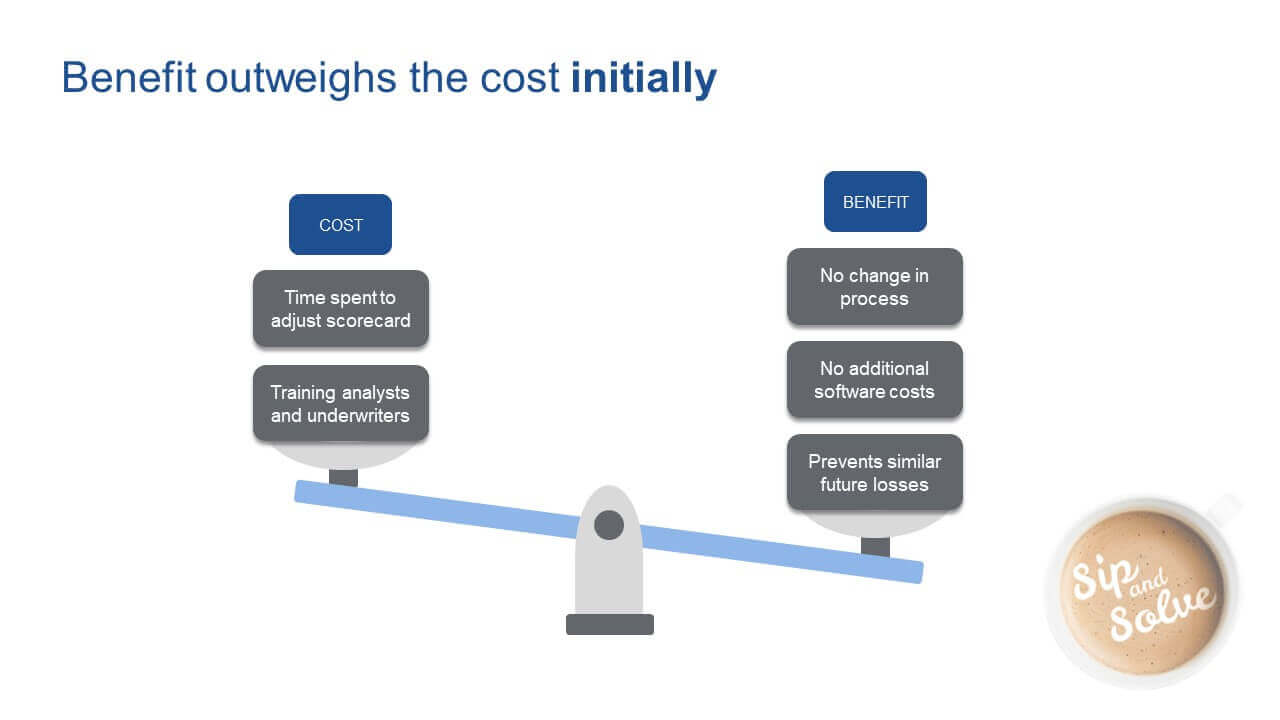

Now here's the common scenario I come across with many of our clients. They might have suffered a recent string of bad debt. And the first reaction is, I review each bad debt and found if I just increase my score cutoff from 681 to 720 I could have prevented a portion of the losses. And if what they see is all these positive benefits without heavily considering the potential other costs, the decisions you'll make likely will go rotten. Just like what happened when I bought coffee purchase.

Key benefits go something like this: Increasing the score cut off, meaning there's no material change in your process, no additional cost to take on and just ultimately decrease risk overall, right? And from a cost standpoint, you're spending really little time adjusting your scorecard, making, maybe speaking with some of our experts to make this change on your end, and then likely turning to your analysts or underwriters all really one-time efforts for the most part.

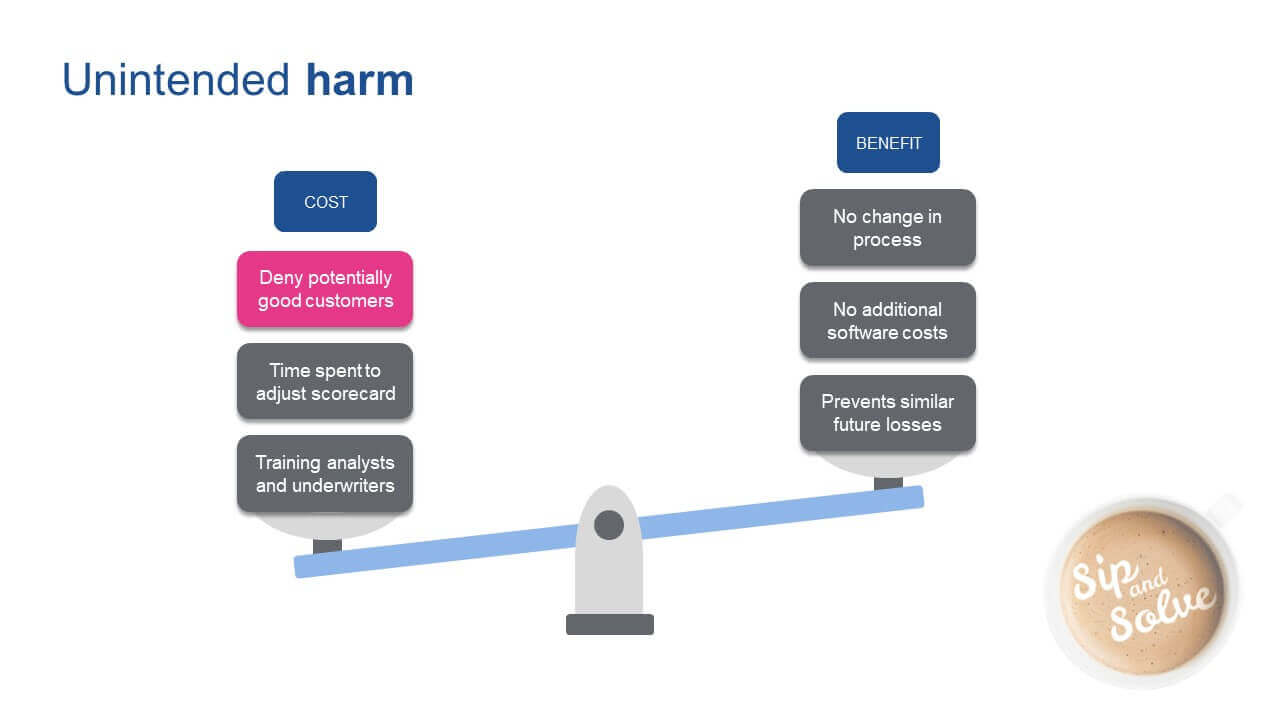

However, a cost that doesn't get quite considered enough is whether this could potentially lead you to decline an actual good customer who may not have an excellent credit score or they're right at your now elevated score cutoff.

What do I mean exactly by good customer? So, what I mean by the good customer is, they have good, but not excellent credit. Typically, good customers without excellent credit could be attributed to these four possible factors I'm showing on my screen. They're likely a newly formed business without a robust credit history of their business. Typically, they're not relying on credit today, but external factors like the pandemic has impacted demands for their product and thus, they’re now needing credit to help stay in business until demand for their product returns, and services returned to normal.

Businesses not as familiar with commercial credit may have not considered how best to leverage the credit that they do have to show they're responsible with their credit. And lastly, not only newly formed businesses, but we do see businesses starting out to leverage their personal credit because they don't have a robust business credit history.

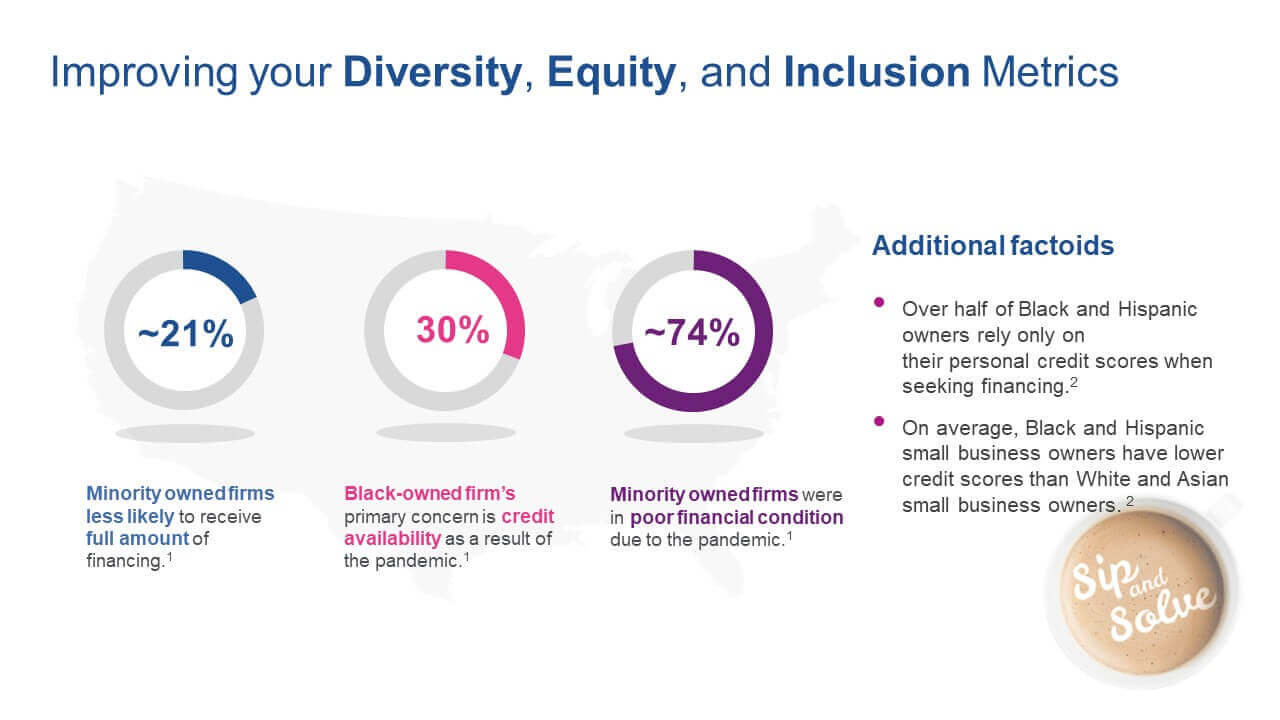

So, in addition to what you don't typically see is the characteristic of good customers without excellent credit group is actually, there's a very specific segment of businesses and in those businesses, they actually impact your diversity, equity, and inclusion efforts.

The segment I’ve been alluding to is minority owned businesses. In a recent survey published by the federal small business report back in February 2021 in this survey, on average 74% of the minority owned firms responded to this survey. They are in poor financial condition due to the pandemic. Yet business owners signaling they need help and likely to start seeking for help. Soon. Additionally, black owned firms, especially their top concern is about the availability or credit to them to help weather this storm. That same respondents about 21% of them, when they do apply for financial support, is actually less likely to receive the full amount of the needed financing. And that might be related to the two additional factoids I have listed on the right is that black and Hispanic owned businesses tend to leverage their personal credit scores when seeking credit and that small business owners typically have lower credit scores when compared to the other business owners.

In essence, you have a minority owned business signaling for help historically have not been successful when they reach out for help. So when you start to consider these additional factors and by increasing your score threshold, there's a likelihood you could be impacting your focus on diversity, equity, inclusion who tend to fall into the segment we're calling good customers without excellent commercial credit.

Well, what can you do instead to prevent the recent string of bad debt? I believe fraud could be at play as we've seen spikes and fraud occurrences in our own data, historically fraud spikes in times of financial distress. In a Credit Research Foundation survey from September of 2020, respondents indicated a 20% increase in fraudulent activity since the beginning of shelter-at-home due to the pandemic.

Again, during these times with financial distress, for small businesses, we see fraud losses pick up significantly. Of the 67% of businesses who deal with consumer goods and wholesale distributors. most were impacted by fraud. As by over two thirds of respondents in the part two of the Credit Today survey indicated. Again, all industries have been impacted, some more than others. Fraudsters do not discriminate. They find the path of least resistance with the highest amount of payoffs. Which is why we're also seeing from this Credit Toda, survey, the respondents are increasing their planned budget by roughly 20%, to place a greater emphasis on fraud detection. Spikes in recent losses due to fraud are really justifying the need for solving the growing fraud concerns now, before the attacks grow even further.

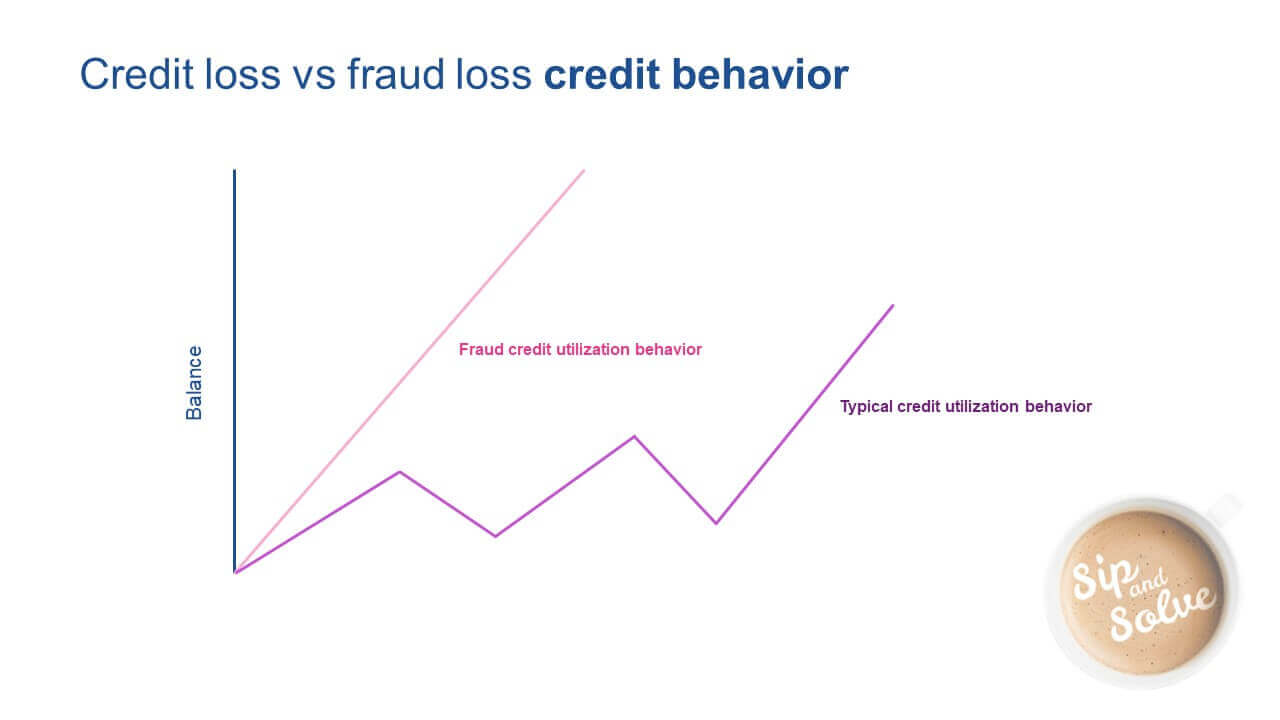

What we're seeing across impacting all industries and what our clients are also telling us is that a large majority of clients today are not differentiating true credit loss from actual fraud loss. This could become a big problem, as I mentioned, because your recent string of charge-offs or bad debt or losses and your need now to revalue your scorecard and tighten your risk assessment could actually lead you to claim those good customers without excellent credit scores, as I have mentioned.

That’s because the behavior of a fraudster is actually different from a good customer with a thin credit history. And also, you don't want to create that unnecessary friction with your good customers by recurring upfront deposits or cash-on-delivery for the same reasons. And if you have a fraud check implemented today, it's likely labor intensive or very manual, which means it could become very costly because you will not see the return on investment without a targeted approach to your fraud strategy.

And that's because you have a subjective approach relying on the experience of your analyst and not a consistent repeatable process using unbiased analytics, data and technology. And if you're relying solely on credit tools today to solve for a fraud problem, that would actually lead to a scenario with the growth of your business could be stunted as some of the good causes, as I mentioned, will start to look at bad customers if you will rely solely on credit risk tools.

Fraud losses can actually account for 5 to 20% of your overall bad debt.

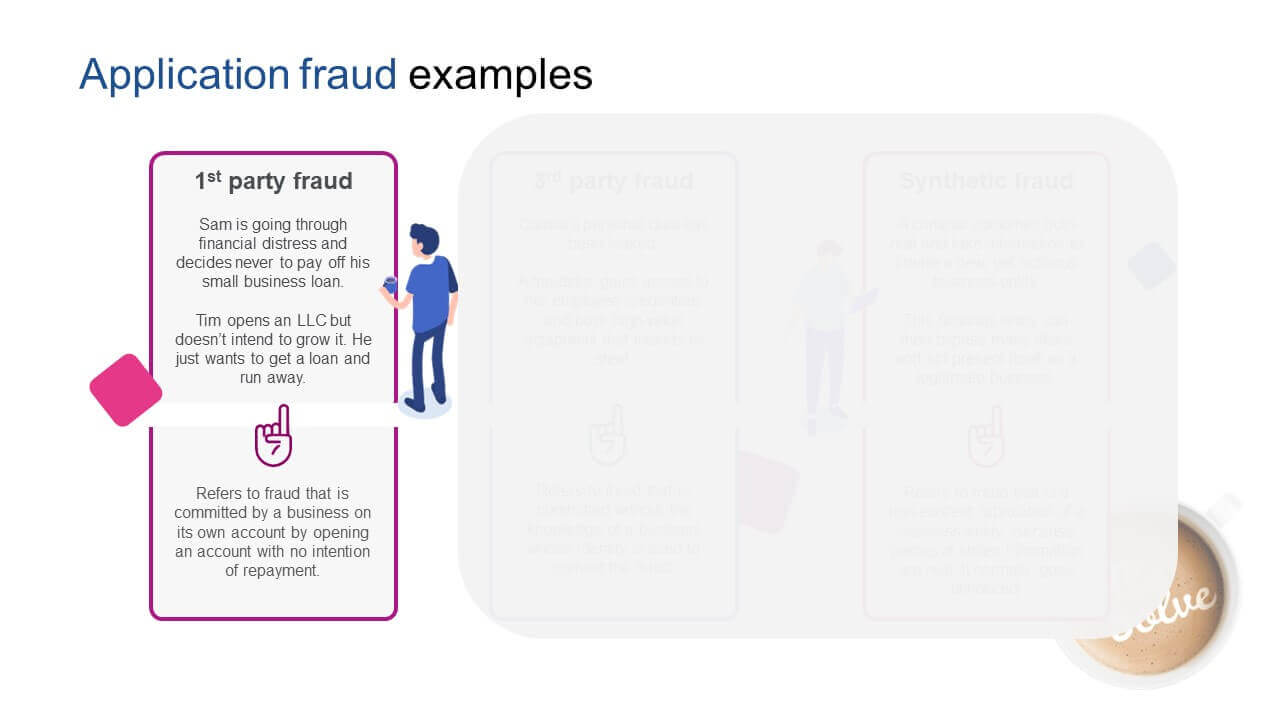

I have a reason to believe the string of bad debt could be due to first party fraud, as this is the most prevalent application fraud that tends to impact many of our clients, especially within the financial services industry. First party fraud is very difficult to solve without credit data because oftentimes, as I mention, it looks like a credit loss to you. Patterns of increasing use in cumulation or credit are important to detection of first party fraud, and I will cover that briefly in a couple of slides, but I like to spend a little time explaining what first party fraud is for those that are not familiar. Specifically, the fraud I've been mentioning is around application fraud: someone committing fraud while filling out your credit application. And there's at least three forms of application fraud. First-party fraud: This is identity theft, or third-party fraud. And lastly, a newer form of fraud called synthetic ID.

But today I'm going to focus on first-party fraud.

First-party fraud refers to a fraud that's being committed by an individual or group of individuals on their own accounts and opening an account without the intention of paying you back, using their own business information to commit fraud. We're currently seeing a higher prevalence of first-party fraud impacting many of our clients.

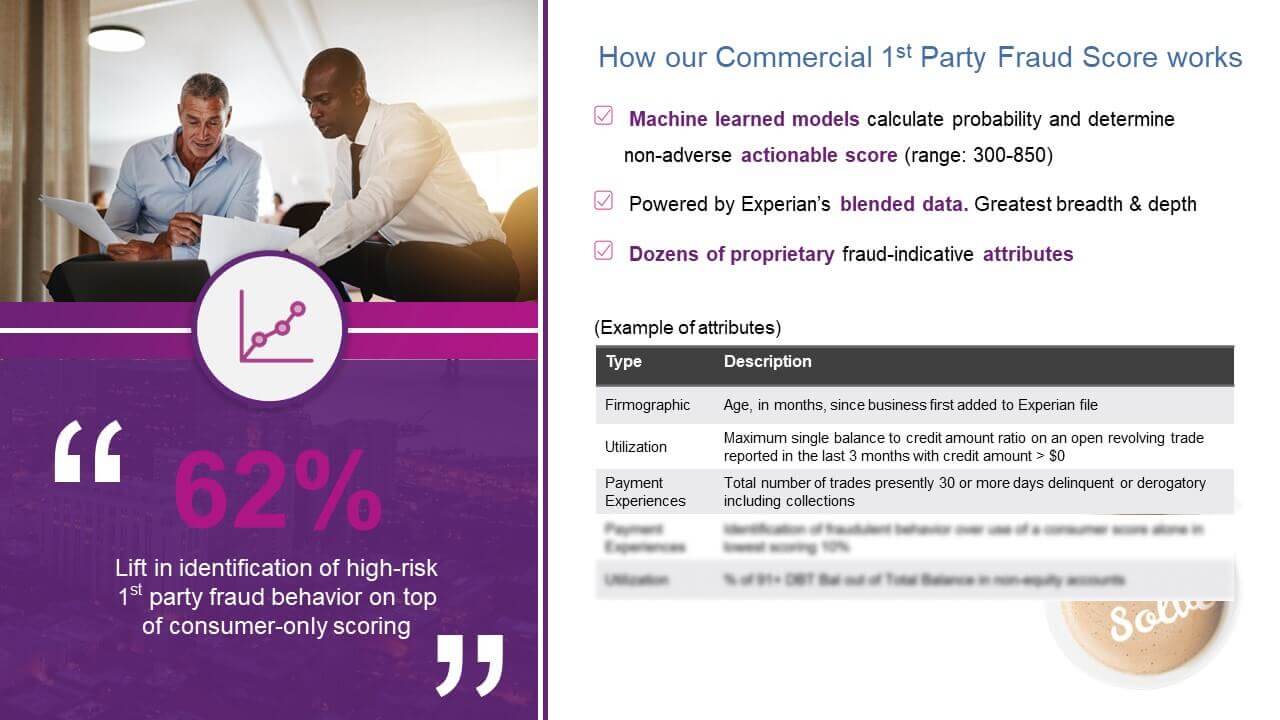

Experian's credit data on businesses is really important as a way to identify the patterns of increasing use and accumulation of credit for detecting first-party fraud. And we have a lot of our data because our score uses and leverages our data from our 28 million+ businesses and our commercial entity database as well as our 250 million consumers credit database. So, while you may only see a single account going bad in your own portfolio, we're able to identify obligations or trades across multiple, different clients.

Experian has a cross-creditor/lender view. While you're only able to see one account, we see tens of thousands of cases where businesses just go bad on a single account, but they accumulate credit on lots of accounts and going bad all at once. This allows us to look at different behaviors or patterns, and we're able to see that first-party fraud tend to bust out really quickly. With this information, we can create models with scores trained to identify this credit behavior quickly and tell you through a score, whether there's first-party risk.

And we recently did develop a new first part of commercial model. Our new first party fraud score predicts the likelihood of that business having your first payment default in the first six months on books. This is a machine learned model, score ranges 300 to 850. The higher the score, the low the fraud risk. It is blended capable, meaning we can score with just using business information or personal guarantor information, but the maximum predictability and performance of the model is achieved when you supply both the business information, any personal guarantors you have in the scoring process.

Blended data's important because leverage is the depth and quality of both our commercial and consumer database. This is important because we observed through our data that the small businesses tend to, as I mentioned, leverage personal credit history when they're first starting out and will shift their financial obligation to the business over time. And small businesses are more likely to be impacted by financial distress and thus the risk for first-party fraud will be higher among the segment.

When we did a comparison of our first-party fraud model against a consumer centric model, looking at first-party fraud as well, our commercial first-party model had a 62% lift in first-party detection rate on top of the consumer-only fraud model. And using the score can actually quickly allow you to evaluate whether a recent string of bad debt is due to true need to adjust your scorecard or whether there could be something more low-level that played, like first-party fraud.

In summary, in today's session I shared with you that commercial first party-fraud is on the rise due to recent market and economic conditions. Fraud losses can actually account for a 5 to 20% of your overall bad debt. Your immediate reaction to adjust your score card to combat a recent string of bad debt could actually lead to the unintended harm of denying potentially good customers. And those good customers actually contain a specific sub-segment of minority-owned businesses that traditionally do not have excellent credit but are good customers overall. So, assessing whether fraud is the cause of your recent bad debt could actually help improve your diversity equity inclusion efforts.

And lastly, please reach out to your Account Executive if you do want to complete our first-party fraud assessment on your portfolio to assess whether there is fraud. But if you're interested in learning more, I want to leave you with a link to a great perspective paper on commercial fraud. As I mentioned, if you have additional questions, please feel free to reach out to your account executives.

That's all I have time for today. So, thank you for spending your coffee break with me. If you have any questions or I want to learn more about what I talked about today, please feel free to also use this link to chat with us.

Let's get back to work.

Li Mao is a Product Manager of our Global Data Network, our international offering that supports companies who are operating internationally manage their risk for customer acquisition and across their portfolio. Li is focused on creating a set of tools that will enable professionals to make the best decision in the most efficient way. He is passionate about leveraging new technologies and challenging the norm in order to move the industry forward.