Four risk scoring options to help modernize your credit approval process

Sip and SolveTM 15-Minute Webinar

Risk Scoring is often a critical first step for any business attempting to modernize its credit approval process. The process can feel daunting, especially if you're new to basic automation principals and scoring concepts. In this session, Erikk Kropp reviews a best practice framework aimed at helping businesses modernize their credit approval process.

In this session you will leave with three key takeaways:

What follows is a lightly edited transcription of this Sip and Solve talk.

Hi everybody, my name is Erikk Kropp, Senior Product Manager here for Experian Business Information Services. I want to welcome you to today's Sip & Solve session. As is customary for any Sip and Solve, we recommend joining us with your favorite morning beverage, whether it's coffee or some espresso, to help get the day started. Every morning, I start my day with a Dunkin Donuts coffee, a little almond milk, and some sugar to get the day started.

I want to jump into our session, which will focus on risk scoring. I was excited to do this session today because it was a continuation of another session a couple of months ago about modernizing your path to improving B2B credit approvals. In that session, we discussed a five-step framework intended to help clients manage and enhance or modernize their B2B credit approval process.

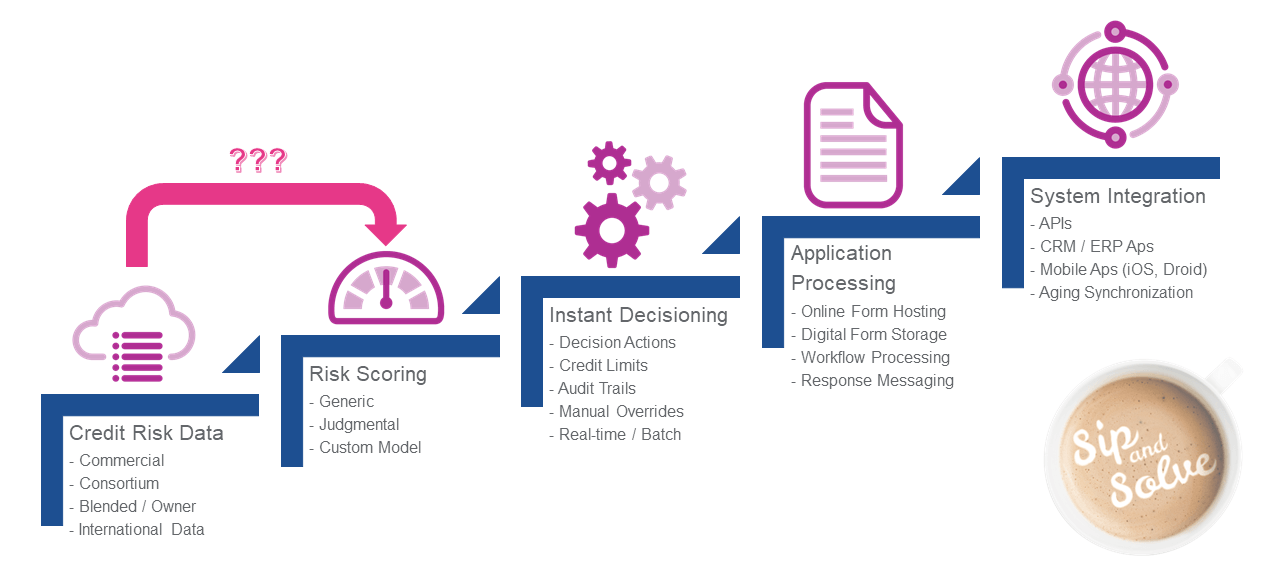

We see a stepping staircase in this first slide. The steps provide a lot of great insights into different levers and services and best practices that customers can implement to go on that journey to modernize their credit approval process.

Today I will focus on making that first step. Perhaps your shop is more manual review oriented, looking at credit report data in its entirety, really combing through those reports, and looking for ways to start driving some efficiencies. Start looking at ways to improve your throughput around application processing.

Perhaps there are those out there looking to improve customer experience and workflow automation. All prevalent trends and themes that we see going on today in the industry space and the concepts of risk scoring that we're going to talk about will help you to make that first step, and we'll provide you with some good things to think about as well as to consider.

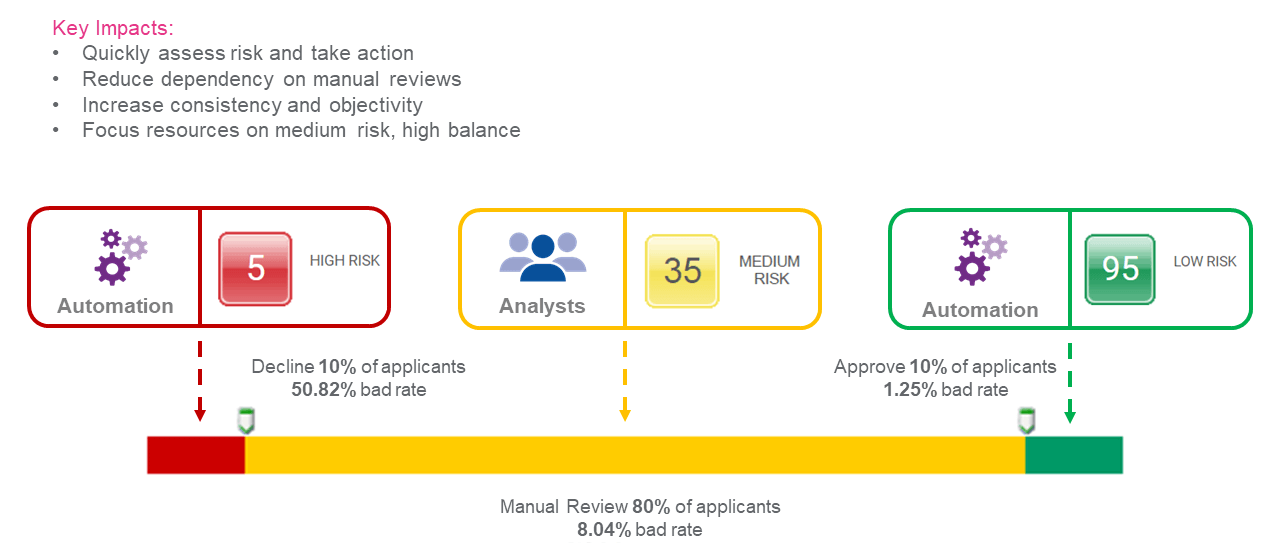

I want to talk about why score-based automation is essential. I think it is shown well by this diagram; you can see it looks like a traffic light. It's a colored bar, it has red, yellow, and green, and these colors represent the number of applications or a hundred percent of the applications that are coming into any given business at a particular period of time. By using the concepts of risk score, and we're instead of looking for a full credit report to determine risk; you're actually looking at key data attributes and perhaps using a score value to determine where you're going to make some of your baseline approvals and baseline declines. It's not necessarily when you first get into this, of course, I have some clients that are very heavy in automation. They automate every single transaction through risk scoring. I have others that are much more conservative.

One of the key recommendations for folks that are first starting this journey is to consider using risk scores at the extremes of that application population — looking at it more for how can I approve my low risk clients? Those no brainers that should be low risk based on scores. We can give them a credit limit recommendation immediately, easily find or determine my high-risk customers. Just as an example, as you see here in this diagram, if I were to apply risk-based scoring automation at the top 10% for my low-risk customers and the bottom 10% for my high-risk customers, that's 20% of my application base that I could potentially automate.

If I am looking to move from manual reviews or looking to better focus my staff, I could take my credit analysts team and focus more on that manual review category to free up that time and become more efficient. This is where many companies start to see the gain in their day-to-day process, and as this ramps up over time, you become more comfortable with risk scoring, and you start seeing the benefits, stakeholders begin to buy-in more over time. You begin to see those extremes start to come down more into that yellow area, and you can even automate further as you become more comfortable. That's typically the path we see a lot of clients take. They become more comfortable with it. The other thing to keep in mind too is you'll also see an increase in consistency and objectivity with your decisions. If before, you had a lot of analysts making independent decisions, you may get some variance into how that aligns with your overall credit policy. So moving to something like this, you can also see some of those differences, but this really answers the question of why I would consider using a score based system.

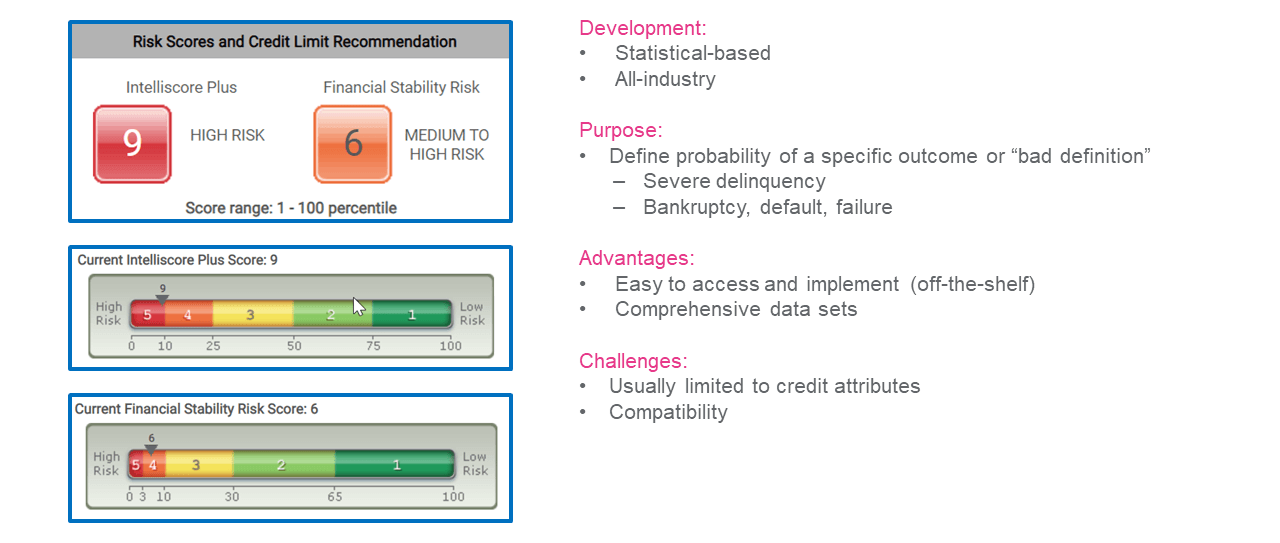

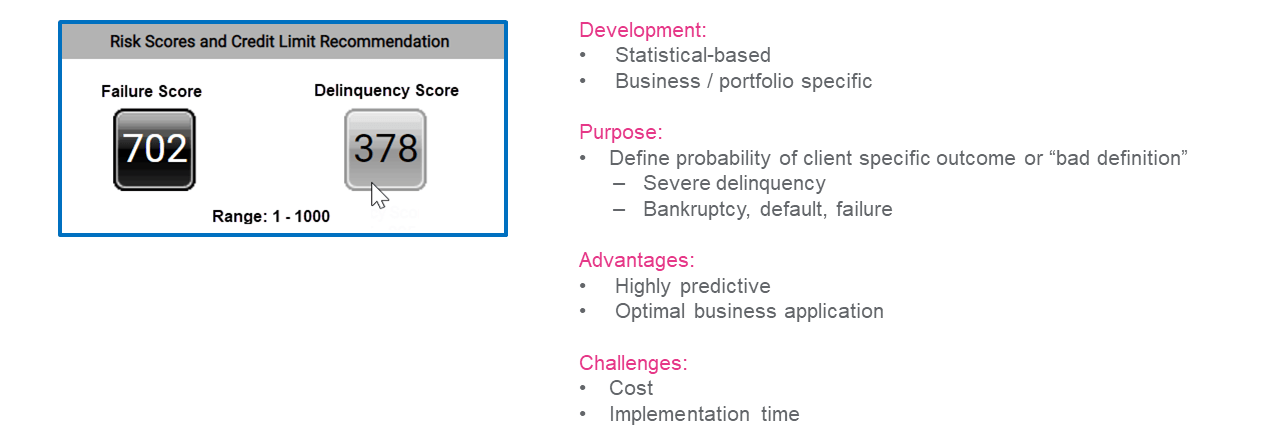

These are four different options to start considering to make these adjustments. One of the first things is you can use something called generic scores. From a development standpoint, these scores are statistically based, meaning they're based on some statistical analysis level. It's typically generated by perhaps the third-party bureau like Experian. Still, there are also multiple other data providers out there in the marketplace, or maybe a third party data science company that builds these types of scores. The scores are referred to as all industries, meaning they're made on a representative sample of the general business population. So they consist of all industries, all types of businesses. So when we talk about deriving risk or assessing risks off these types of generic scores, it's intended to benchmark against the general business population as far as performance. The purpose of these scores is to define the probability of a specific outcome or what we also refer to in the industry as a "bad definition."

Some of the more common ones you'll find in a B2B commercial credit space are around severe delinquency, such as one time 90 or two times 60, perhaps around more of a severe condition of will I even get paid at all through bankruptcy, default, or failure risk? Those are very common. On the left-hand side of this screen, you'll notice I included two generic scores just as a frame of reference that Experian Business Information Services provides. IntelliScore Plus, a Delinquency Score and Financial Stability Risk Score, assesses the risk of bankruptcy and default. Below that, I've also included what we call default risk classes and risk bands. You can probably start to pick up quickly by using a generic score. There are some key advantages, mainly because I can quickly get access to this data, and I can implement a scoring strategy around these generic scores and almost an off the shelf manner.

Generic scores are already included in a lot of the base credit reports that you're already accessing today. As you look at the score, it's relatively easy to interpret. For instance, I can look at a score value and determine what type of risk class it falls into based on the model performance that's high risk. If I have any type of performance tables or charts associated with the model, I can get an idea what the probability that bad definition or outcome might be, such as what is the likelihood of delinquency? What is the likelihood of bankruptcy or default? And that makes life a lot easier when you're just starting to adopt a risk scoring strategy.

A couple of other things to keep in mind too is that these scores are built off very comprehensive data sets. They're validated on millions of business records. They also simultaneously assess multiple risk attributes at the same time. So anytime you see a score, you can be assessing hundreds of different data attributes simultaneously. It's very comprehensive from a risk management standpoint.

You might encounter pros and some challenges with adopting something like this in your very own process. One of the things you may run into is these types of scores are usually oriented around credit attributes from a specific data set or credit report. In some cases, you may have a situation where you look at other things beyond that. So, this score may not be the end-all, be-all to make a final credit decision. Based on your process, you may be looking at other items like financial statements.

Another thing to think about is compatibility. Generic scores are modeled off the general business population. You may find edge cases or corner cases where the score represents a particular way of looking at risk. You might look at it somewhat differently. Sometimes those edge cases and corner cases can be challenging to manage in your process. Some will work through that if they're using generic scores, and others may look at using a different method, or some other techniques we'll talk a little bit more about. But generic scores are a great way to go when you're first moving down this path.

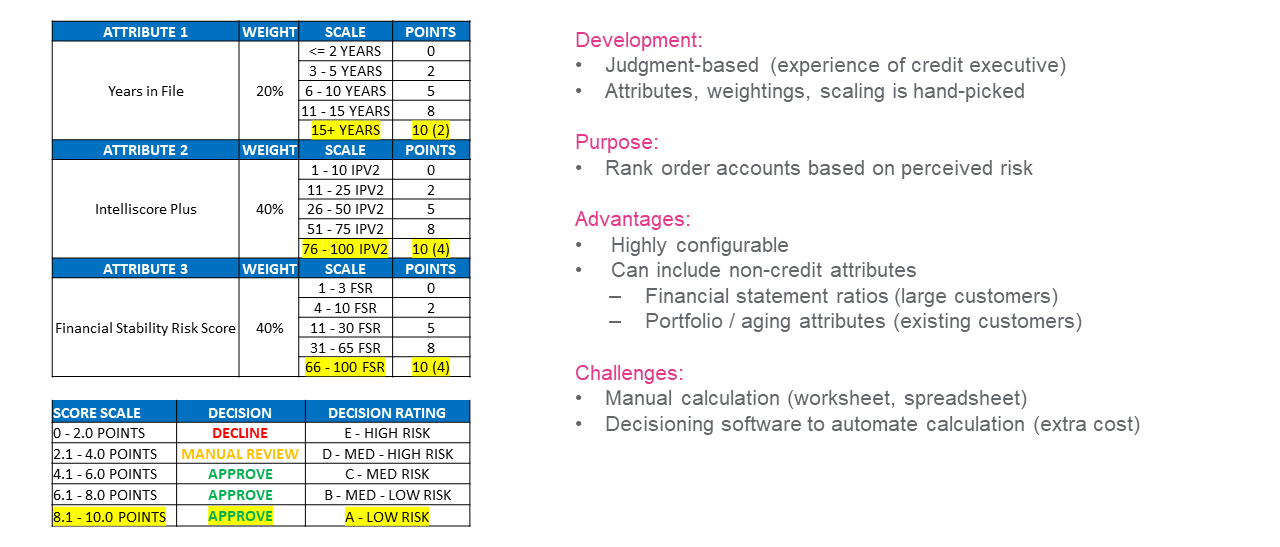

I also want to talk to you about another option at your disposal —a Judgmental Score. When you first hear the term judgmental, people have a negative connotation. They're like, "Oh, it's judgmental! what does that mean?" It's more indicative of how the score is derived. It's based on the judgment or the experience of the credit executive developing the score. That means the attributes, the weightings, and the scaling are handpicked by that credit executive or groups of credit executives, based on their perception of risk for their business, their industry, and perhaps based on their own experience. It's not based on any type of statistical analysis. The purpose of these types of scores is not to predict a specific outcome. Because again, it's not based on any statistical analysis, it's more designed to rank-order accounts based on the perception of risk in accordance with that credit executive.

I included a sample judgmental score on the left, something straightforward just to provide an example for those just trying to understand better how something like that would work. You can see we have three attributes that have been hand-picked — there are Years in File, IntelliScore Plus, and Financial Stability Risk Score. Each one has an associated weighting. I can determine which attributes are most critical, giving more weight over one to another one.

We can create a scoring scale and point distribution system that says essentially based on this attribute, what do I consider low-risk to high-risk on that spectrum? And how do I perhaps assign point systems to be indicative of that risk?

When a new account comes in, you apply this scorecard, and you'll look at each data attribute. In essence, calculate what the points would be for each one. You'll develop a composite score. In this example, you'll see a score scale of zero to ten, zero being the highest risk, ten being the lowest risk. That's how judgmental scores or scorecards are executed, and how the scores are derived.

From there, a credit executive can align that with their decision as well as their decision ratings. Some of the advantages of this type of methodology are it's highly configurable for your business. We talked about compatibility or perhaps edge case management. This approach allows you to configure things exactly as you see them within your process. The other thing is, it's not displayed here in the example, but you can also include non-credit attributes. You can have items such as maybe financial statement ratios for larger customers that you might be assessing for enterprise and cashflow. Perhaps you want to look at the portfolio and aging attributes for existing customers to get more of a 360-degree view of both your internal performance, as well as external performance using data coming from another type of credit reporting agency or data source. There are some challenges to consider. It's heavily dependent upon calculation. And sometimes, that could be manual depending upon where you are in your modernization framework. Lots of times, we'll see someone with a worksheet or perhaps a spreadsheet that executes the calculation and the summarization of these data values.

Other clients who look at a more significant number of decisions make software purchases to help automate that collection. There are some excellent software platforms out there today that can enable that, but that does come with some cost.

A third option is something called a custom model score. Custom model scores are very similar to a generic score. They are based on statistical analysis, and there's typically a third party, perhaps a bureau or data science company that would build it on your behalf. Instead of scoring a business based on the general business population or representative sample, custom model scores are built on your own business and portfolio performance. They will literally take your portfolio, analyze it, determine what risk factors are most indicative of the bad definition you're choosing, where you're trying to prove out. They will develop the scaling around that model, in essence, build it from the ground up.

With custom model scores, the purpose is to define the probability of a specific outcome. Lots of times, we see models built around the same bad definitions you would see around severe delinquency, bankruptcy, and default failure to be very common. Custom model scores are highly predictive because they're based on your own portfolios, business performance. It allows for optimal business applications. As you start becoming more score-based, and it starts impacting your day-to-day credit decisions, it's going to impact where you book your revenue. It's going to affect your profitability and your losses. So even though there may be some challenges around the initial costs to do the analysis, build and deploy the score through a technology that can ingest it. This method has a very good return on investment. Keep in mind; there may be some additional wait time around implementation.

Our first two options were more commonplace, but we are seeing a trend in the industry going this route. Even if you are relatively new to the process because folks that know the value here are trying to put in more analytical expertise into their process to get the best results possible.

We also see new technologies that help to reduce challenges around cost and implementation time, which becomes really valuable.

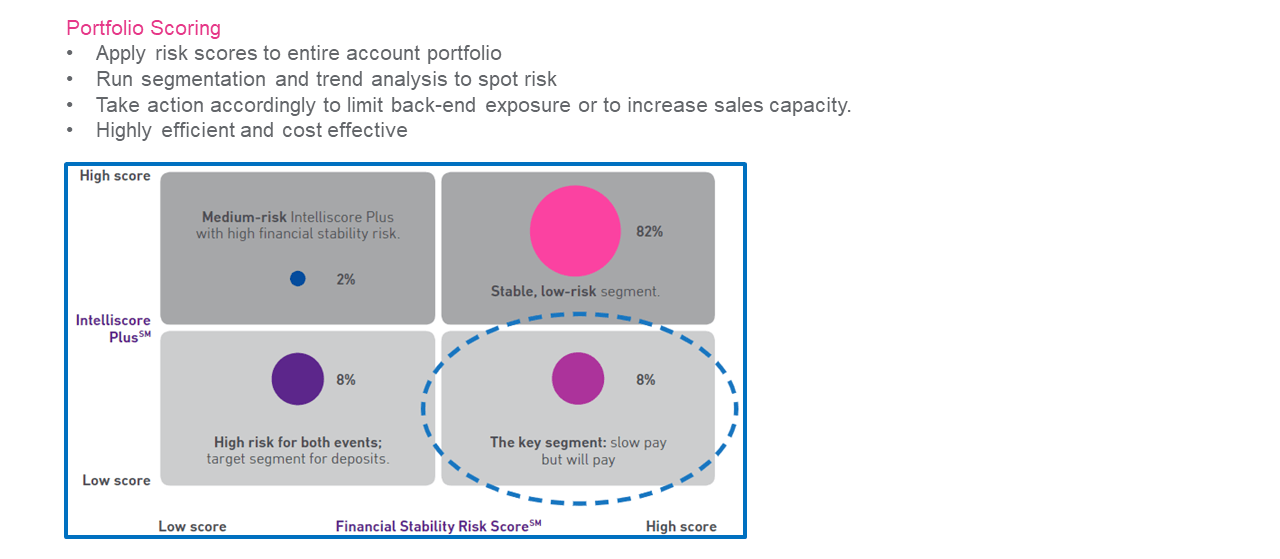

The fourth option I want to talk about is critical in today's economic environment – the ability to apply scores for portfolio management. Many of you are all probably concerned with COVID-19 and the discussion of a recession due to all the demand being taken out of the economy. What's going to happen? How do I manage my portfolio more effectively and more efficiently? One thing to think about is not just a risk score strategy on your front end, but maybe also consider it on the backend. Can I apply risk scores to an entire account portfolio in a batch or bulk format? Once those scores are applied, you can then run segmentation and trend analysis to spot risks in your existing portfolio base and, over time, take action accordingly to potentially limit that backend or maybe to increase sales capacity in areas where you think there's less risk.

This creates a highly efficient, highly cost-effective way to start managing that process. I included a little snippet here of just something simple we do with some of our clients today with generic scores, where we provide IntlliScore Plus and Financial Stability Risk Score in more of an X and Y axis plot them out. We can get an idea of what segments of the portfolio are stable and low risk of both events for delinquency and default and bankruptcy. We can see where we have high risk, maybe where you want to start monitoring those accounts much more closely start taking actions, and start managing those relationships more proactively. Maybe there's a segment that may slow pay, but, you know, they will pay, and you can better work with those when it comes to collection strategies, et cetera. That's just a very simple example to get you thinking about how you might be able to extend risk scores out from just the acquisition phase of your business.

So I will close with some parting thoughts. When you start making this initial transition and taking the first step, know your options, educate yourself about what's out there; hopefully, a session like this gives you some basic ideas. I know it's only 15 minutes. I could probably spend three hours providing you with a little better education of what's out there and what might be the best fit for your particular business and, most importantly, your comfort level.

Have realistic expectations. You're going to set goals and milestones on how to make these conversions, but be realistic, knowing that you're just starting that first step in your modernization process. There's a lot of other measures to consider. Try not to go from zero to 60 in under three seconds. Do it at the right pace for your organization.

Last but definitely not least, seek the right partners. You want somebody who's flexible with expertise in the space, but at the same time keeps your best interest in mind. Especially if you plan how you want to approach that path to modernization in your own company, that becomes critical.

With more than 14 years’ experience, Erikk Kropp is a Senior Product Manager with Experian working in Business Information Services. His responsibilities include managing operations and strategy for DecisionIQ. Prior to joining Experian Erikk held both sales and operational positions in the banking and software industry. He has a B.A. from Gettysburg College with a concentration in Business Management and Economics.

We will be scheduling more Sip and Solve sessions. Sign up below to be notified.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.