Optimizing B2B Marketing Data

Sip and Solve™ 15-Minute Webinar

With uncertainty about the U.S. economy growing, businesses across the country remain focused on maintaining a positive cash flow. One way to impact that is to make sure your marketing campaigns perform well. To help with this, we have put together a series of three 15-minute Sip and Solve webinars with our experts about B2B marketing.

This first webinar focuses on optimizing your B2B marketing data. Bad data means you are wasting money because you're not reaching your target audience in the most effective way possible. Clean, robust and comprehensive data means you can identify your data segment, and then make sure you're able to communicate that message to them clearly.

In this 15-minute Sip and Solve talk we cover:

Hi everyone. This is Tony Romero, Senior Product Manager at Experian. First of all, I wanted to say thank you for joining. And I brought my Sip and Solve cup today. Drinking some coffee. Hopefully you enjoy my presentation today.

So this one is about B2B marketing data and all of the challenges around it, and some of the things that you can do with marketing data. So first of all, let me talk about some of the things that marketing data is used for, when marketers are out there working on their objectives, there's primarily three types of objectives.

The first one is, you've got an existing customer base, now you're ready to grow. And so you're reaching out to a new audience. And for that new audience, you want to make sure that you're investing your marketing budget properly and not wasting any money. So you want to make sure that you're going after the right people and that your campaign is effective.

You might be looking at a multichannel type of campaign. Ultimately, trying to get to those marketing qualified leads that can turn into sales qualified leads. Another main objective is for marketers to be able to maximize their customer's potential, basically fostering a deeper relationship with existing customers by offering them other products that they may be needing.

So that could be upsell and cross sell opportunities for your company. And finally retaining current customers. Say for example, you've got a customer who could be looking to refinance or looking to go into other type of products, and basically, increase the lifetime value of that existing customer.

Any one of those three types of objectives, what are some of the main pain points? Some of the ones that we've been hearing from marketers is trying to get high quality leads. You know, it's very hard to make sure that you're spending your dollars correctly and making sure that those leads that you're getting back truly can turn into customers and can be a revenue potential.

So it's important to make sure that, to get those high quantity of quality leads, that you've got good data quality. There's no gaps in your records. There's obviously constant changing changes with marketing data. if you see in the bottom here in the little box, marketing data changes quite a bit; approximately 17% of business data changes each month.

So you can see how it's important to keep your data correct. But also current. we talked about ROI and then lastly, making sure that you're reaching the right audience at the right time. And that's very important because the last thing you want to do is bring in people or businesses that aren't really the right fit for your products or services.

So now let's take a look at what are some of those important pieces of data, that you should be considering when you're creating any type of marketing campaign as we've talked about. one is marketing lead data. So being able to get firmographic data on your prospective clients, the next one is predictive credit data so that you can actually take a look at how viable this business is.

as well as being able to segment on their credit-based data. Also taking a look at who are those consumers behind that business, because you don't want to just promote to the business itself. You want to promote to that individual who's part of that business that gives you not only a holistic view of who your customer is, but it also lets you reach them in their own consumer based ways that they engaged with the internet.

So whether it's social media or through display ads or emails, you're reaching that individual. And then lastly, diversity and inclusion data is something that's fairly new, but so important. When you think about the last few years with COVID, there's been a lot of companies that have been impacted by that.

But number one is the underrepresented minorities, as well as women-led businesses, they've been struggling quite hard and they had a pretty large impact. So being able to reach those type of minority-led and women-led businesses is something that is a great way to increase your diversity in your portfolio.

And lastly, you want to be able to have this data available through batch, or maybe through API. You want to be able to have those capabilities to get that data.

Now, what are some of the use cases that marketing data can be used for? Well, it can be used for market research. Being able to identify the universe of who's in your total available market or shareable market.

You want to be able to extract and generate lists. Secondly, data enrichment. You may want to take a look at your existing portfolio and realize that you're missing some of the data, and you want to add additional firmographic data or demographic data on the consumer themselves. There's a plethora of data that you might not currently have in your database that you want to enrich.

Lookalike analysis is another interesting use case where you take a look at your existing customer base. And you identify what makes them a valuable customer to you. And from that lookalike analysis, you can then segment and go prospective marketing out to the general universe, looking for that same type of business that would be an ideal customer for you.

Data management and hygiene, again, as I mentioned before, data churns very quickly. And so it's very important to keep your data as correct and current as possible. So going through data hygiene on a periodic basis is a great way to make sure that content is fresh.

And then lastly, lead generation form for prefills. It's a great way to reduce friction by being able to prefill information that you have on your customer when they're filling out forms in order to reduce the amount of work they have to do to get through whatever the process that they're going through the funnel.

Now, let's take a look at marketing lead data. And it's important to know that when you're thinking about this type of data, you want to make sure it's comprehensive and correct and current. So, our data, we have over 17 million US businesses in our database. We source them from a lot of different sources in order to make sure that again, it's it's very comprehensive and correct.

For each business, we have a lot of information. That's firmographic. So company name SIC and NAICS codes are fantastic to be able to segment on specific industries or company types, phone numbers, number of employees, the years that that business has been in business is very important. You also can get information about the site.

Geographical information might be important to you. How many people work at that site, and also information about the people as well; contact information, names, addresses, email addresses, all very important.

Besides the firmographic data. It's also important to think about the predictive credit score data that can also be used in effective marketing campaigns.

So some of the things that you may want to think about when you are segmenting your audience, is to think about how well they're doing as a business. And business aggregated data, or bizAggs, as we like to call it, is a great way to identify how the credit health of the businesses that you're promoting to.

And you might want to use this data to create what we call knockout rules, meaning that if somebody's had derogatory items in the course of so many months, for example, you may not want to go out and promote to them. Score thresholds are another one that's very important.

Two type of scores that we have available. One is the IntelliScore, which will basically give you the sense of, will I get paid on time. Do these businesses pay their bills routinely? And then there's the FSR or Financial Stability Risk score. And that's basically saying, will I get paid? Is this company healthy or are they maybe going bankrupt?

Another type of data that is very important is to consider the consumer to business linkage. And this data is really, interesting. One way to look at it is that a business may be new and hasn't developed enough of a credit profile yet. but the business owner may have a strong credit profile.

So being able to identify the business owner to the business means that now you can promote to that business owner directly, and that could be through email, social media, display ads. And that's a great way to reach out to the actual person behind the business, to promote to them. One of the interesting data points here is that you get a 40 to 50, 50% higher rate if you're selling to existing customers versus to new customers.So this is a great way to cross sell and upsell to those folks.

As I mentioned too, the underrepresented community could be minority-led businesses or women-led businesses. And we've recently just launched some indicators. So this information that can be added to your own prospective, or to your existing customer list or to a prospect list, as to what type of businesses do you have here that are minority-led or women-led. On the minority led indicator we can state is this business led by a minority and what is the main ethnicity?

So for example, if there's three stakeholders within the company, two are two are Hispanic and one is African American. We can label them as a Hispanic-run company; very important information to be able to do benchmarking, to see how diverse is your portfolio. But also important to go out and do marketing to these type of companies.

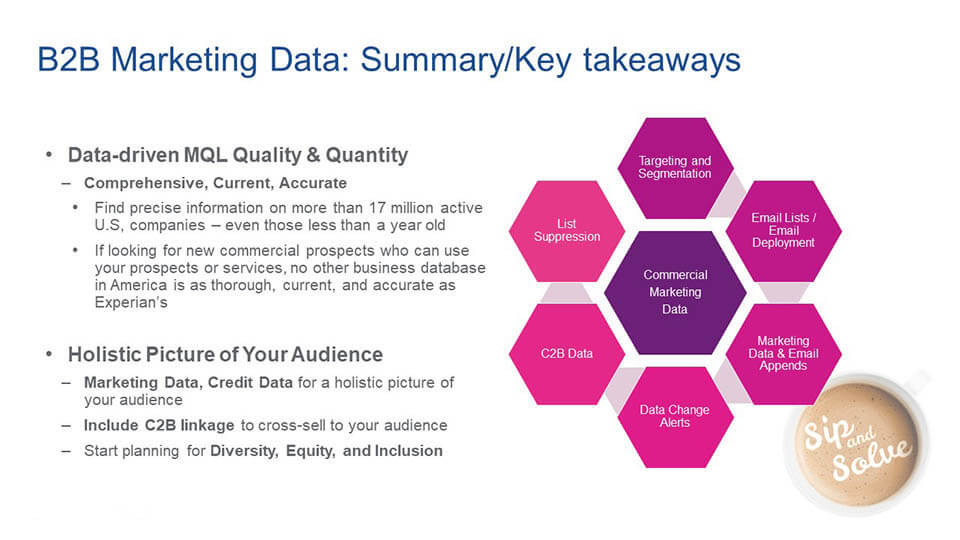

So some key summary takeaways. You know, again, I can't stress enough to make sure that your market lead data is comprehensive, current and accurate. It's going to be very important in order to make sure that your marketing qualified leads, are very quality level and that you've got a lot of them, in order to make sure that you're fulfilling your funnel.

So again, it's important for comprehensiveness to make sure that you're getting all the data that you need. Experian has 17 million active US businesses in the database. Some that are even less than one year old. If you're looking for new commercial prospects, you can use our services to help get you the type of marketing campaigns you need to be successful and also to meet your budgets and your ROI.

So again, besides just thinking about marketing data, think about all the other types of data that are available to you. There's the credit data available to give you a holistic picture of your audience, including BizAggs and the type of credit scores needed to identify the health of your companies that you're going after.

Think about the consumer to business linkage in order to reach out to the individual that's behind the business. And also, I really encourage you to think about diversity, equity and inclusion, and making sure that your portfolio is diverse and you're going after and helping support minority-led and women-led businesses.

Well, that's all I have for you today. Thank you for spending your coffee break with me. Hopefully I was able to help you with useful insights on B2B marketing. If you would like to gain some additional insight, why not join our private group on Facebook? You can engage our experts, access exclusive content and chat with peers.

Just scan the QR code. Also, if you want to get notified of future sessions, make sure to join the list. So thank you for listening to this, and now let's get back to work.

Tony recently joined the Experian BIS team as a Senior Product Manager. He has experience in product lifecycle management, product ideation and strategy, business development, forecasting, performance management and data-driven decision-making, and more.

Tony says, "As a Product manager, it is critical to properly define the criteria to success and key performance indicators. Defining these metrics, collecting and analyzing the data, and testing out options provides the level of preparation, and data-driven decision-making required by a Product Manager to lead with confidence for new initiatives, develop roadmaps and drive it to success."